AAA Visa Signature Credit Card: Bank of America is the company that issues the AAA Visa Signature Credit card. There is no annual charge, and you can still receive cash back even if you are not a AAA member. On every purchase made by members, they earn 3% cash back. Non-members get 2% cash back in grocery stores, wholesale clubs and petrol stations in addition to 3% cash back on travel expenditures. Additionally, there is a no-interest introductory offer on balance transfers and a $200 bonus.

For those looking for a credit card without an annual fee that offers greater cash back on travel, the AAA Visa Signature Credit Card might be the best option.

There is an annual fee associated with several travel-related credit cards, such as the Chase Sapphire Preferred. Others don’t have an annual fee but don’t have a higher earning threshold for travel, such as the Bank of America Travel Rewards card. The Bank of America credit card awards a fixed 1.5 points for every dollar spent.

With this card, you may earn an additional 2% on regular expenditures like groceries, petrol and medicines. People who frequently purchase at wholesale clubs may find it extremely helpful. Wholesale clubs are not eligible for 3% cash back on food purchases offered by cards like the Capital One SavorOne

AAA Visa Signature Credit Card Rewards

After making $1,000 in purchases with their new card within the first 90 days of opening their account, new cardholders are eligible for a $200 statement credit.

The prizes on this card are tier-based:

• 3% cashback on AAA and travel-related purchases that qualify

• 2% cash back on eligible purchases from supermarkets, gas stations, pharmacies, and wholesale clubs

• 1% cashback on additional purchases

Although Bank of America refers to the gains as cash back, the benefits are actually given as points. Due to the 3% cash back, cardholders get three points for every dollar spent on eligible goods.

Top Benefits

Some noteworthy benefits of the AAA Member Rewards Visa Signature® Card include:

No yearly charge

There is no yearly charge for the AAA Member Rewards Visa Signature® Card. A great strategy to reduce extra expenditures while using a credit card is to choose one without an annual fee.

Not necessary to be a member of AAA

To be eligible for the AAA Member Rewards Visa Signature® Card, you don’t have to be a AAA member. Although this is the case, AAA members might benefit more from the card.

Offer for a $200 statement credit bonus

New cardholders will benefit from an extra $200 statement credit offer. Spend at least $1,000 within 90 days of account opening to be eligible for this bonus. Many other rewards cards are comparable to this bonus offer.

Gain up to 3 points for every $1

You can earn in a number of ways when using the AAA Member Rewards Visa Signature® Card to make purchases. Depending on the kinds of purchases you make with your card, you can earn in the following ways:

• Acquire three points for every dollar spent on qualified AAA purchases including travel purchases.

• On eligible petrol, supermarket, wholesale club, and pharmacy purchases, receive two points for every dollar spent.

Earn 1 point for every $1 spent on other purchases.

When compared to many travel rewards credit cards, the earning rate on AAA and travel-related transactions is noteworthy. Additionally, this card doesn’t disqualify wholesale club transactions from collecting points like some rewards cards do.

No earnings limit

The amount of rewards you can earn is capped on some reward credit cards. The AAA Member Rewards Visa Signature® Card has no earning restrictions. Your earning capacity is limitless.

Travel accident insurance for $500,000

Your AAA Member Rewards Visa Signature® Card will immediately qualify you for up to $500,000 in common carrier travel accident coverage when you charge whole travel packages to it. This perk applies to both domestic and international travel.

Collision damage waiver for car rentals

For damage to covered rental cars brought on by collision or theft, the AAA Member Rewards Visa Signature® Card comes with an auto rental collision damage waiver. You must use this card just for the car rental and refuse the rental car company’s offer of collision damage waiver insurance. Most rental cars are eligible for coverage up to their real monetary worth. When you are in your home country, this coverage is an addition to your standard auto insurance.

You can exchange your points for gift cards, cash back, vacation, and AAA certificates in addition to these other options. When points are exchanged for cash back, they are only worth $0.01. While the value of the other redemption options varies, purchasing AAA gift cards can increase the value of your points by up to 40%.

The amount of added value depends on how many points you’re redeeming:

• Points from 5,000 to 19,999: 20% more worth

• Between 20,000 and 49,999 points: 25% greater worth

• 50,000 points or more: 40% greater worth

For instance, you would receive $500 in cashback after redeeming 50,000 points. In contrast, you may obtain $700 in AAA certificates by exchanging 50,000 points.

Absence of foreign transaction fees

When using the AAA Member Rewards Visa Signature® Card for international transactions, there are no foreign transaction fees assessed. 3% is typically charged by these cards for each international transaction. It’s advantageous to have no international transaction fees if you intend to use your card when travelling abroad.

Balance transfer introduction 0% APR

The first 12 statement periods of the AAA Member Rewards Visa Signature® Card offer a promotional 0% APR on balance transfers. Within the first 60 days of account ownership, you are required to perform balance transfers.

This 0% APR deal can give you the chance to pay off existing credit card debt without accruing more interest fees if you wish to address it. Each balance transfer will incur a 3% balance transfer fee, with a $10 minimum charge.

JCPenney Credit Card Activation: Steps To Apply, Perks, Alternatives, Payments, and FAQs

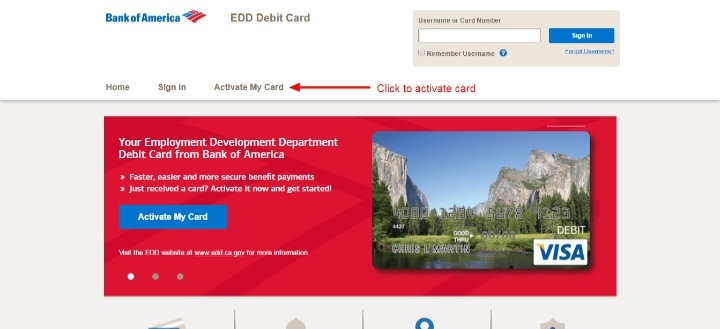

How to Activate AAA Visa Signature Credit Card?

The new AAA Visa Signature® credit card must be activated by the primary cardholder on the account either online or over the phone by dialling 1-855-334-3640 for the Travel Advantage Visa or 1-866-349-1742 for the Daily Advantage Visa. Please be prepared with your new card and information. The last four numbers of the other cards on the account can be added in order to activate cards for authorised buyers.

Call Customer Care at 1-800-305-1219 (AAA Daily Advantage Visa Signature®) or 1-855-546-9552 (AAA Travel Advantage Visa Signature®) (TDD/TTY: 1-888-819-1918) if you need help activating your card.

Your brand-new AAA Travel Advantage credit card ought to be in the mail now.Your new AAA Travel Advantage credit card is now active and ready to use!You should destroy your previous card for security reasons. Please activate the card by following the directions on the card.

Register for online account management at AAA.com/Advantage.

• Make sure any businesses that automatically charge your account (such as utilities, phone services, gym memberships, streaming subscriptions, etc.) have the most recent version of your card information.

• Enrol in paperless billing so that your choices are carried over to your new account.

• Deposit money into your account.

• Enable automatic payments on your credit card account (please be aware that the initial automatic payment might not go through until your subsequent billing period).

• Get to know your new account’s features and advantages.

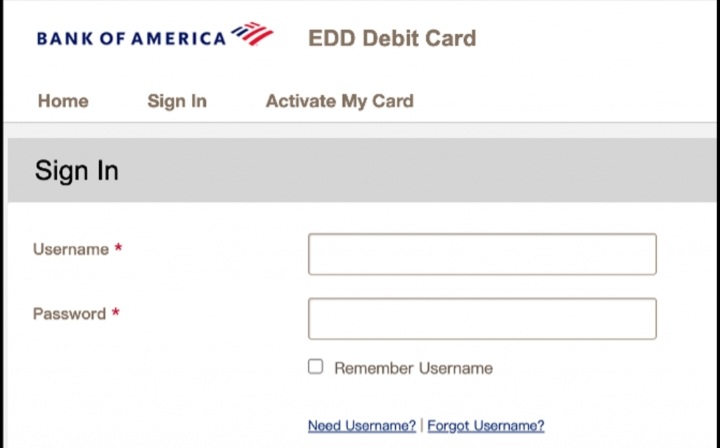

How can I access my account?

To obtain an account number, you must be an AAdvantage® member. There are a few options for joining:

- You may already have an AAdvantage® number if you have an AAdvantage® credit card.

- To create an account online, select a username and password.

- If you don’t remember your AAdvantage® number, you can retrieve it at login where it says, ‘Need AAdvantage number?’.

- If you don’t remember the password you chose when you created an account, you can request it at login (click ‘Need password?’).

- Check ‘Remember me’ at login so you don’t have to re-enter your AAdvantage® number / username and last name every time you visit the site. Next time you log in they will already be filled out, so you can just enter your password.

- If you don’t want the site to autofill that information, log out then uncheck ‘Remember me’ at login.

How do I update my user name or reset my password?

To modify your login information or password:

• Access your profile.

• Choose “information and password”

• Refresh your information

Online Registration

If you wish to use Comenity.net to register your credit card so you may access and manage it online, let’s say. But what do you need before creating your online credit card account?

To finish your online application for an account, you must enter all of the necessary data. You must carry out these actions to ensure that nobody else can access your account.

• To register, you must be older than 18 years old.

• It is recommended to utilise IP addresses with US locations.

• Any account number or AAA Visa card that you have previously applied for.

• State your social security number or other means of identification.

• The birthdate.

• Identification is performed by providing a phone number or email address in answer to a query or enquiry.

Please take note that you must give your AAA Credit Card authorization to disclose essential information in order to complete the registration procedure. You must agree to receive disclosures electronically by checking the appropriate boxes and giving your permission.

• Click the following link to see the official website: https://comenity.net/advantage

• Select Register Now by swiping down.

• Type in the necessary information, which includes “Credit Card Account Number, ZIP Code or Postal Code, and Last Four Digits of SSN.”

• After completing all the fields, select Find my account.

• Online Credit Card Account Registration.

You may access and manage your card after entering into your account and registering your card.

Online AAA Credit Card Application

Customers who want to apply for a new credit card can do so through the enrollment site offered by the AAA Credit Card. For its loyal customers, Comenity Capital Bank provides a variety of incentives.

Eligibility

• You must be at least 18 years old to apply.

• Possess a valid photo ID from the government;

• Possess a legitimate tax identification number issued by the government, such as a Social Security number (SSN) or Social Insurance number (SIN);

• Possess a street, backroad, or APO/FPO postal address. Postal boxes are not accepted as postal addresses.

Online Method:

• The company’s official website [https://aaa.com/CreditCard]

• However, you must read the terms and conditions before clicking Apply Now; after doing so, click Apply Now.

• Type in the necessary information, which includes your name, street address, social security number, and date of birth. Click Proceed once all the information has been entered.

• After that, continue by following the instructions provided to apply for your card online.

Payment Methods

How to Pay with a AAA Credit Card via Mail?

You can choose to mail a credit card payment if you receive bills and statements on paper:

• Create a cheque or money order in the amount you want to pay.

• Write your card and account information on the bill, then put the payment coupon for the statement in the envelope.

• Send the payment by mail to the location listed on the paper statement or envelope.

• You ensure prompt delivery and save late fees, make sure you post your payment at least a week before it’s due.

Credit Card Payment Address

Visa AAA

P.O. Box 650967

Texas, Dallas, 75265-0967

How Can I Use My Phone or Tablet to Make a Credit Card Payment?

Call your credit card’s customer support number to pay your credit card bill over the phone:

You can use your AAA Credit Card to make free phone credit card payments. You need to gather your bank account number, credit card details, and credit card number in order to make a payment over the phone. Call 1-800-305-1219 to make a phone-based card payment. After the call, arrange your payment by following the automated prompts.

How to Use EasyPay to Make a AAA Credit Card Payment?

EasyPay, which doesn’t require registration or logging in, is another option for making an online payment. This is how to apply it:

• On the banner at the top of the online account login page, click “EasyPay”.

• Type in the necessary information, including your zip code, credit card account number, and the last four digits of your SSN.

• Please select “Find My Account.”

• To finish your payment, adhere to the on-screen instructions.

Every time you use EasyPay, you must provide your bank account details. Your data is not stored by the system. The ability to change or halt payments you make via EasyPay is also unavailable.

What Are the Late Fees for AAA Credit Cards?

You must pay at least the minimum amount due by the due date listed on your billing statement in order to avoid late fines. The usual overdue fine is $27. However, the charge will rise to $41 if you make another late payment within the subsequent six billing cycles.

AAA Visa Signature Credit Card Customer Service

• Call 1-800-305-1219 or 1-855-546-9552 (TDD/TTY: 1-888-819-1918) to contact credit card customer support for payments or other assistance. 8:00 a.m., Monday through Saturday. to 9:00 p.m. EST. On Sundays, New Year’s Day, Easter, Memorial Day, Labour Day, Thanksgiving, and Christmas, they are closed. The Live Customer Care hours may vary on holidays.

Website: Visit AAA.com/Advantage.

Frequently Asked Questions

What are the value of AAA Visa points?

The AAA Members Rewards Visa card is issued by Bank of America, which awards rewards in the form of points. Members receive 3% cash back on purchases, earning three points for every dollar spent on qualifying items.

What can you do with points with a AAA credit card?

Points can be redeemed for gift cards, vacation, cash back, and AAA rewards certificates. But there are requirements before you can start using prizes. To receive cash back benefits, cardholders must have at least 5,000 points. Additionally, after five years, points run out. If you keep them too long, they lose their value.

What are the Visa Rewards for AAA?

Rewards on the AAA Visa are tier-based. Non-members receive 3% cash back on AAA and travel-related items that qualify, 2% cash back on eligible retail, wholesale club and petrol purchases, and 1% cash back on all other purchases. Most other reward cards exclude purchases made at wholesale clubs.

How do I use my points from the AAA Member Rewards Visa?

You have the option of receiving your cash back rewards by cheque, statement credit or direct deposit into a Bank of America account. To redeem your points, simply visit AAAnetaccess.com or the Bank of America Mobile Banking app. You can also go to a AAA location or dial 1-888-271-6987.