AAdvantage® Aviator® Red World Elite Mastercard®: Spending a four-figure sum quickly is typically required to be eligible for a five-figure sign-up bonus (no pressure!). With the AAdvantage® Aviator® Red World Elite Mastercard®, which offers a simple sign-up bonus, that is not the case. You only need to make one purchase and pay the annual fee in the first 90 days to finish. Any purchase, regardless of price, will do. Therefore, purchasing a pack of gum could be the first step towards booking a holiday at a significant discount.

American Airlines frequent fliers will value the benefits of the Barclays-issued AAdvantage® Aviator® Red World Elite Mastercard®. However, similar to many co-branded airline cards, American is heavily incorporated into the benefits. A credit card with general travel rewards would probably be a better option for you if you aren’t loyal to any one airline in particular.

Also available from Barclays is the AAdvantage® Aviator® Silver Mastercard®, an upscale American Airlines credit card. If you ask for an upgrade from the AAdvantage® Aviator® Red World Elite Mastercard®, it is available.

AAdvantage® Aviator® Red World Elite Mastercard® Benefits

A large welcome bonus without a spending limit

You often need to spend a particular amount — sometimes $3,000 or more — in the first three to twelve months you use a travel rewards card in order to qualify for the sign-up bonus. Reaching the spending requirement can be difficult on your finances unless you generally spend enough or have a significant buy coming up. This is why the AAdvantage® Aviator® Red World Elite Mastercard®’s® sign-up bonus is exceptional: After making your first purchase and paying the $99 annual fee in full within the first 90 days, you will receive 60,000 AAdvantage® bonus miles.

Companion certificate per year

You can acquire a companion certificate that allows you to take a second traveller for $99 (plus taxes and fees) if you spend $20,000 in an anniversary year and keep the card open for 45 days following your anniversary date (i.e., the day you start being charged the annual fee again).

Added features that facilitate travel

On the same American Airlines reservation, you and up to four guests will receive one free checked bag and priority boarding. For domestic flights, the first checked bag is $30, so this benefit might easily pay for the $99 yearly charge. Along with 25% off in-flight food and beverage sales, you’ll also receive a $25 bill credit annually for in-flight Wi-Fi purchases. This discount will come in the form of a statement credit.

Obtain status by using a credit card

Spending on credit cards with the American Airlines logo, such as the AAdvantage® Aviator® Red World Elite Mastercard®, can earn you AAdvantage status points. One loyalty point equates to every mile you accumulate on the card. The lowest category, AAdvantage Gold, can be obtained by acquiring 30,000 loyalty points. Flying on American Airlines, American Eagle, and oneworld partner airlines, as well as dining at participating restaurants, can also earn you reward points.

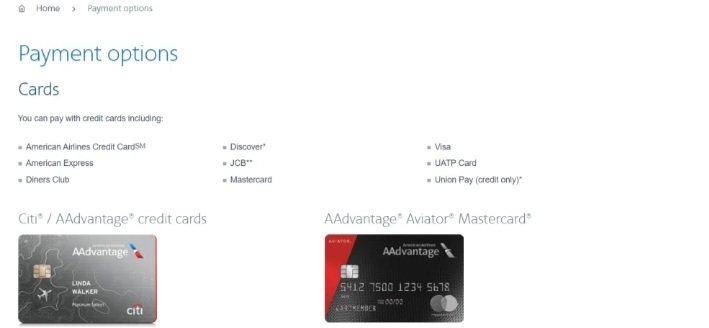

Can be used in conjunction with additional American Airlines cards

The fact that American Airlines provides co-branded credit cards from Barclays and Citi, two different issuers, sets it apart from other airlines. This implies that you are able to have several credit cards that all deposit bonus miles into your AAdvantage account. And since you receive your sizable sign-up bonus from the AAdvantage® Aviator® Red World Elite Mastercard® after just one purchase, you don’t have to worry about hitting two spending thresholds at once.

Combine that card with another, like the Citi® / AAdvantage® Platinum Select® World Elite Mastercard®, to get an even bigger sign-up bonus and more AAdvantage miles. Additionally, you’ll receive greater rewards for regular purchasing. The Citi co-branded card offers double miles on a variety of eligible purchases, unlike the AAdvantage® Aviator® Red World Elite Mastercard®, which only applies to American Airlines expenditures. Petrol stations and eateries are additional categories.

Convert pennies into miles

You can round up purchases to the closest dollar with the optional Flight Cents programme, and then use the excess money to purchase AAdvantage miles. The “spare change” from all purchases up to your specified threshold, which can range from $1 to $500 (or $0 if you like to opt out), will be saved until the day before your billing cycle expires. Your savings will be converted into miles at a rate of 0.5 AAdvantage miles per penny. (Or, to put it another way, it costs 2 cents each mile.)

Is that cost per mile reasonable? The answer is a resounding “maybe” because you can purchase miles at a discounted cost during special periods, and the amount of the discount you would receive depends on how many miles you purchase. In either case, purchasing frequent flyer miles is normally not the best course of action because the cash price per mile is frequently significantly more than the value you receive when you redeem the miles (as opposed to earning them by taking flights or using a credit card).

Other benefits

• Free checked baggage for cardholders and up to four additional passengers on domestic American Airlines flights.

• Preferred boarding for cardholders and up to four additional passengers on the same reservation on all American Airlines flights.

• A certificate for annual companionship.

• Discounts on in-flight purchases: Save 25% on in-flight food and beverage purchases on American Airlines-operated flights (you’ll receive the discount in the form of a statement credit), and receive up to $25 back per anniversary year as statement credits on in-flight Wi-Fi purchases.

• Purchases made using credit cards count towards AAdvantage loyalty status.

Additional Information

- Reward rate: 1 mile for every $1 spent on all other purchases, and 2 miles on eligible American Airlines purchases.

- Welcome bonus: 50,000 AAdvantage points with one transaction and complete payment of the annual card charge within the first 90 days.

- Cost per year: $99

- Purchase-Introduction APR: 0

- For transfers made during the first 45 days, the balance transfer introductory APR is 0% for 15 billing cycles.

- Variable Regular APR: 20.74%, 24.74%, or 29.74%

How To Activate AAdvantage® Aviator® Red World Elite Mastercard®?

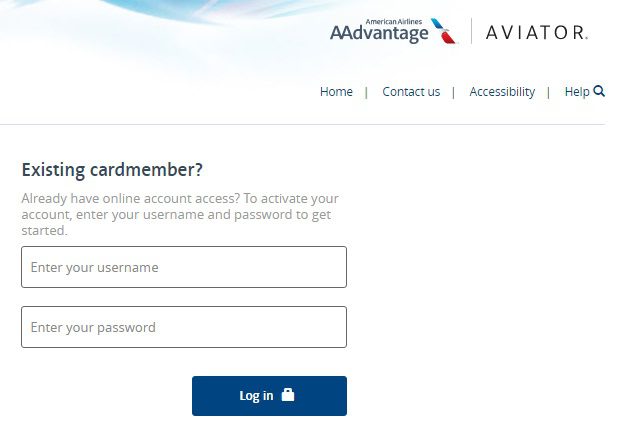

Make sure you have an Aviator Mastercard Account before continuing with the card activation. To activate your Aviator Mastercard online at aviatormastercard.com/activate, enter the four-digit PIN of your online account. If you don’t already have one, establish one by following the guidelines below.

Instructions for Activating an Aviator Mastercard activating aviatormastercard.com

- Visit https://www.aviatormastercard.com/servicing/activate to see the Aviator Mastercard’s site.

- You must log into your account from the homepage by entering your username and password. If you are not already a member, select New Card Member? and then choose Activate my card now. This will advance you to the following page.

- On the following page, you must provide some necessary information and input it in the corresponding fields to confirm your identification.

- The information you must provide is your card’s last four-digit Social Security number, date of birth, account number, security code (found on the back of your card), occupation, and whether or not you are a US citizen.

- Have you completed inputting all the necessary data? You will reach the following screen after selecting the Continue option.

- To finish the account registration process, be sure to follow the on-screen instructions.

- The next step is to follow the instructions below to activate your new Aviator Mastercard at aviatormastercard.com/activate.

- On your computer or mobile device, launch a web browser and go to aviatormastercard.com/activate. To access the activation page, enter the following URL in the address field and press Enter or OK.

- Click the Activate my card now button on the card activation page. You will be prompted for some information in order to verify this.

- Enter your date of birth, the last four digits of your Social Security Number, your account number, your employment, your security code, and if you are a US citizen on the next screen.

- After providing the appropriate information, click the Continue button.

- After selecting the Continue button, you will be taken to the following screen to complete the activation process.

By phone

Dial (877) 408-8866 to reach the credit card activation line. To activate your credit card, check your personal details (such as your Social Security number, card number, or application-related phone number).

Mobile App

Use the same login information you would use to log in online to the iOS or Android mobile app, or choose “Activate my card now” and follow the on-screen directions.

No matter whatever method you choose, your new card will be ready to use for purchases in a matter of minutes. Although there is no set period of time in which the issuer must activate your card, it is recommended to do so right away.

How To Contact After Activation?

If you are having trouble activating your card at aviatormastercard.com or need help with another issue, get in touch with the AAdvantage Aviator Mastercard customer service provider and ask for assistance.

To get in touch with the Aviator MasterCard, click here.

You have three alternatives to submit your question on the screen that appears after that. So choose one of them and inform the appropriate authority:Policy statement for mail, phone, and complaints

• Select the option you wish to favour and ask for advice on your issue

• Alternatively, you can reach American Airlines Customer Service Team by dialling 888-232-0780.

• Call 866-928-8598 or complete an online form to report your card as lost, stolen, or to report unauthorised purchases.

You can use these methods to get in touch with the Aviator MasterCard service at aviatormastercard.com/activate to solve any activation-related problems.

JCPenney Credit Card Activation: Steps To Apply, Perks, Alternatives, Payments, and FAQs

How to Apply for an AAdvantage® Aviator® Red World Elite Mastercard®?

Are you interested in having an American Airlines Aviator Master Card in your wallet?

Look up instructions on how to apply.

- Visit the aviatormastercard.com main page.

- Select the button labelled “Learn More” on the homepage.

- It will bring you to the screen where you may apply for an Aviator MasterCard.

- Select “Apply Now” from the menu.

- To learn more about the card details, choose the “Terms & Conditions” option.

- Complete your application’s required fields, including First Name, Email, Phone, Address, Date of Birth, and Location (US).

- You might also be required to disclose your financial information.

- Check the box to indicate your agreement to sign up for the account.

You can earn 60,000 AAdvantage Bonus Miles after making your first purchase within 90 days of the activation of your card once your application for the American Airlines AAdvantage has been accepted.

AAdvantage® Aviator® Red World Elite Mastercard® Payments

• Online: To pay your American Airlines Aviator Red Card bill online, sign into your account and select “Pay your bill.” Additionally, you can pay your bill using the iOS and Android mobile apps.

• Over the phone: Call customer care at (877) 523-0478 or the number printed on the back of your credit or debit card to make a payment over the phone.

• By mail: Send a cheque or money order (but not cash) to the following address to settle your credit card by mail:

Card Services

PO Box 60517

City of Industry

California 91716-0517

Always submit payments via mail at least 5-7 days before the due date if you decide to do so. To prevent any delays in processing, add your credit card number to your payment as well.

AAdvantage® Aviator® Red World Elite Mastercard® Penalty Fee

• Annual fee: The $99 fee for the AAdvantage® Aviator® Red World Elite Mastercard®.

• Foreign transaction fee: The AAdvantage® Aviator® Red World Elite Mastercard® charges 0% of all transactions made in U.S. dollars as a foreign transaction cost.

• Balance transfer fee: You must pay $5 or 3% of each transfer’s value, whichever is higher.

• Advance Fee: 5% of each cash advance’s amount or $10, whichever is greater, is charged as a cash advance fee by the AAdvantage® Aviator® Red World Elite Mastercard®.

• Penalty fee: $40 maximum for a returned or late payment.

Customer Service

Follow these instructions to contact the American Airlines Aviator Red Card customer service:

• Dial (866) 928-3075 to reach the customer support department.

• Press “0” when asked to enter your card number.

• Remain silent when prompted to give the reason for your call and wait to be connected to a live agent.

You can always send a secure message from your online account to American Airlines Aviator Red Card customer support if you are unable or unable to speak with them on the phone. You may also send a mail to the following address instead:

Postal Address:

8801 Wilmington,

DE 19899-8801

The quickest way to contact American Airlines Aviator Red Card customer support is by phone, where you can speak with a person right away.

Frequently Asked Questions

What is the turnaround time for the AAdvantage® Aviator® Red World Elite Mastercard® bonus?

After the prerequisites have been met, the sign-up bonus miles will appear 4–6 weeks later.

Is it worthwhile to get the AAdvantage® Aviator® Red World Elite Mastercard®?

Anyone wishing to accumulate worthwhile AAdvantage programme miles may want to consider getting the AAdvantage® Aviator® Red World Elite Mastercard®. It provides a straightforward sign-up bonus, a minimal annual charge, and other practical card features. Nevertheless, depending on how often you fly with the airline, you might want to have a look at alternative American Airlines credit cards.

For the AAdvantage® Aviator® Red World Elite Mastercard®, what credit score is required?

You’ll probably need a strong to outstanding credit score in order to qualify for the AAdvantage® Aviator® Red World Elite Mastercard®. Your creditworthiness and other factors will be taken into account by the card issuer when deciding whether you qualify for this card.