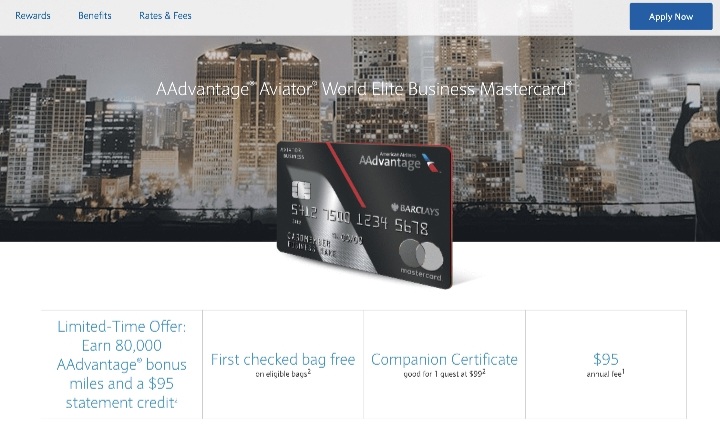

AAdvantage® Aviator® World Elite Business Mastercard®: With the sizable welcome bonus on the AAdvantage® Aviator® World Elite Business Mastercard®*, business owners can quickly raise their American Airlines balance. The one-time incentive is comparatively simple to get, and continued spending allows you to accumulate more airline miles throughout the year.

The value of the card is less objective after the welcome bonus. For elite travellers or anyone who currently has an American Airlines personal credit card, many advantages are redundant. Other incentives that have been advertised have high minimum spending requirements that not everyone will meet. Due to this, only a portion of American Airlines passengers will benefit in the long run by using this card.

The opportunity to double down and accumulate miles from credit card spending is valuable even if you already have access to the same privileges through American Airlines elite membership. For every dollar spent on American Airlines products, such as tickets and other expenses, cardholders receive two miles. Additionally, 2 miles are available for purchases of telecom, office supply, and rental cars. At the conclusion of each cardholder year, all cardholders receive an extra 5% bonus on the miles they racked up using the credit card.

The card also comes with two additional perks for heavy consumers. A companion voucher that lets you to purchase a domestic economy ticket for a friend at a fixed price of $99 when you purchase one for yourself at the going rate is given to cardholders who spend $30,000 or more annually.

AAdvantage® Aviator® World Elite Business Mastercard® Benefits

- After making at least $3,000 in purchases within the first 90 days of opening your account, you can earn 30,000 online bonus points, which can be exchanged for a $300 statement credit towards travel or dining expenses.

- No matter how much you spend, you can earn an infinite 1.5 points for every $1 spent on any purchases made anywhere, at any time.

- There is no cap on the number of points you can accrue, and points never expire.

- If you have a business checking account with Bank of America and are eligible for our highest Preferred Rewards for Business tier, you can earn up to 75% more points on every purchase. This means that for all purchases, you can accumulate up to an unlimited 2.62 points for every dollar spent.

- There are no yearly fees or fees for overseas transactions.

- Choose your preferred method of redemption, such as cash back, gift cards, travel with no ban dates, or a statement credit to offset dining and travel expenses.

- For your first 9 payment cycles, there is a 0% introductory APR on purchases. When the introductory APR offer expires, a variable APR that ranges from 18.49% to 28.49% will take effect.

- Contactless Cards – These cards combine the convenience of a tap with the security of a chip card.

If you visit our website or leave this page, this offer might no longer be valid. When you apply right away, you can benefit from this deal.

How To Activate First Premier Credit Card? Steps, Benefits, Payment Methods, and More

Advanced Features

- American Express lounges: Free admission to the Centurion lounge network operated by American Express, which has locations in a little under a dozen American airports.

- Additional airport lounges: Priority Pass Select membership grants you and two guests free access to more than 1,300 lounges globally.

- Airport screening: $100 in statement credits for Global Entry every four years or $85 in statement credits for TSA PreCheck® every four and a half years.

- Travel credit: Up to $200 in yearly statement credits for expenses associated with flying travel, such as baggage fees and in-flight refreshments.

- Elite status with a number of automobile rental companies.

- Free Wi-Fi: 10 annual passes for free in-flight Gogo Wi-Fi.

- Refund for redeemed points: Up to 500,000 bonus points each calendar year, 35% of points are refunded when you purchase a flight in business or first class.

- Statement credits from Dell of up to $400 each year for purchases from Dell.

How to Activate AAdvantage® Aviator® World Elite Business Mastercard®?

Make sure you have an Aviator Mastercard Account before continuing with the card activation. To activate your Aviator Mastercard online at aviatormastercard.com/activate, enter the four-digit PIN of your online account. If you don’t already have one, establish one by following the guidelines below.

Instructions for Activating an Aviator Mastercard activating aviatormastercard.com

- Visit https://www.aviatormastercard.com/servicing/activate to see the Aviator Mastercard’s site.

- You must log into your account from the homepage by entering your username and password. If you are not already a member, select New Card Member? and then choose Activate my card now.This will advance you to the following page.

- On the following page, you must provide some necessary information and input it in the corresponding fields to confirm your identification.

- The information you must provide is your card’s last four-digit Social Security number, date of birth, account number, security code (found on the back of your card), occupation, and whether or not you are a US citizen.

- Have you completed inputting all the necessary data? You will reach the following screen after selecting the Continue option.

- To finish the account registration process, be sure to follow the on-screen instructions.

- The next step is to follow the instructions below to activate your new Aviator Mastercard at aviatormastercard.com/activate.

- On your computer or mobile device, launch a web browser and go to aviatormastercard.com/activate. To access the activation page, enter the following URL in the address field and press Enter or OK.

- Click the Activate my card now button on the card activation page. You will be prompted for some information in order to verify this.

- Enter your date of birth, the last four digits of your Social Security Number, your account number, your employment, your security code, and if you are a US citizen on the next screen.

- After providing the appropriate information, click the Continue button.

- After selecting the Continue button, you will be taken to the following screen to complete the activation process.

By phone: Dial (877) 408-8866 to reach the credit card activation line. To activate your credit card, check your personal details (such as your Social Security number, card number, or application-related phone number).

Mobile App: Use the same login information you would use to log in online to the iOS or Android mobile app, or choose “Activate my card now” and follow the on-screen directions.

No matter whatever method you choose, your new card will be ready to use for purchases in a matter of minutes. Although there is no set period of time in which the issuer must activate your card, it is recommended to do so right away.

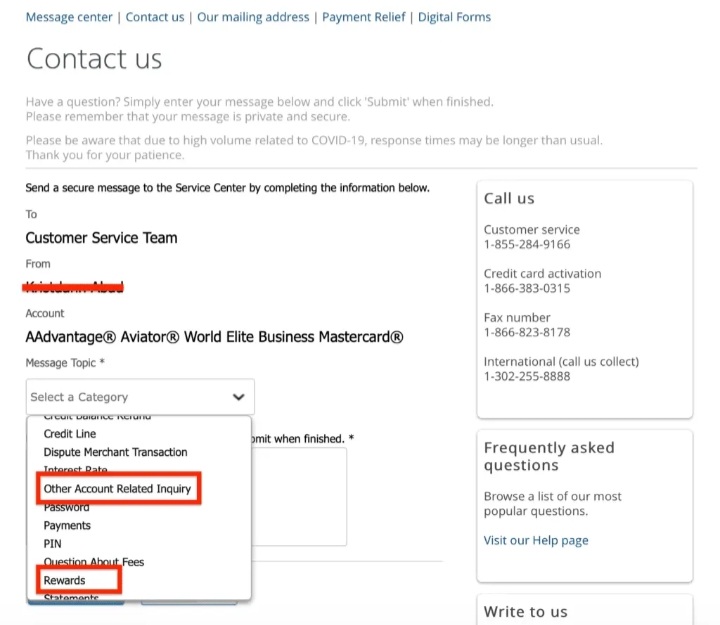

How to Apply for an AAdvantage® Aviator® World Elite Business Mastercard®?

Are you interested in having an American Airlines Aviator Master Card in your wallet?

• Visit the aviatormastercard.com main page.

• Select the button labelled “Learn More” on the homepage.

• It will bring you to the screen where you may apply for an Aviator MasterCard.

• Select “Apply Now” from the menu.

• To learn more about the card details, choose the “Terms & Conditions” option.

• Complete your application’s required fields, including First Name, Email, Phone, Address, Date of Birth, and Location (US).

• You might also be required to disclose your financial information.

• Check the box to indicate your agreement to sign up for the account.

• Complete the remaining procedures and apply for a Mastercard without difficulty.

You can earn 80,000 AAdvantage Bonus Miles after making your first purchase within 90 days of the activation of your card once your application for the American Airlines AAdvantage has been accepted.

Payment Methods

Barclays App

The Barclays App, which is available for iOS and Android smartphones, allows cardholders to set up credit card payments in a manner similar to that of its online banking counterpart. By entering the payment date, sum, and account information for each automatic payment, you can also set up recurring payments.

Call

Dial (877) 523-0478 and follow the instructions to make a payment successfully.

By mail

Use either of the following addresses to send your payments:

Card Services City of Industry,

California 91716-0517

PO Box 60517

Other Address:

Card Services 19101-3337

PO Box 13337 Philadelphia,

Pennsylvania

• For overnight credit card payments, send the required labels and envelopes to one of the following addresses through UPS, FedEx, or USPS mailboxes:

Lock Box 60517 Remitco Card Service

2525 Corporate Pl., Ste. 250

Monterey Park, CA 91754

Other Address

Cards 400 White Clay Centre Drive,

Newark, Delaware

19711

Fees to Consider

Annual fee: AAdvantage® Aviator® Red World Elite Mastercard® charges a $99 annual fee.

Foreign transaction fee: The AAdvantage® Aviator® Mastercard® has a foreign transaction fee of 0% of each transaction in U.S. dollars.

Balance transfer fee: Pay either $5 or 3% of the amount of each transfer, whichever is greater.

Cash advance fee: AAdvantage® Aviator® World Elite Mastercard® charges either either $10 or 5% of the amount of each cash advance, whichever is greater.

Penalty fee: Pay up to $40 for a late or returned payment.

Frequently Asked Questions

What credit score do I need to get the AAdvantage Aviator Mastercard?

The AAdvantage Aviator Mastercard is recommended for those with good to excellent credit, which FICO typically defines as a score above 670.

Does the AAdvantage Aviator Mastercard have an annual fee?

Yes, the AAdvantage Aviator Mastercard has a $99 annual fee.

Can I use my AAdvantage Aviator Mastercard anywhere?

You can use your AAdvantage Aviator Mastercard anywhere that Mastercard is accepted. Plus, you won’t be charged a foreign transaction fee when shopping abroad.