FICO vs Credit Score: If you apply for a credit card, a home loan, a personal loan, or even an apartment for rent, one digit is always present and it is your credit score that such a number plays a major role in the decision making process. Despite this fact, a lot of people consider the terms ‘FICO score’ and ‘credit score’ as synonyms, which most of the times leads to misunderstanding. Are they one and the same? Is one more crucial than the other? And what score is checked by the lenders?

What Is a Credit Score?

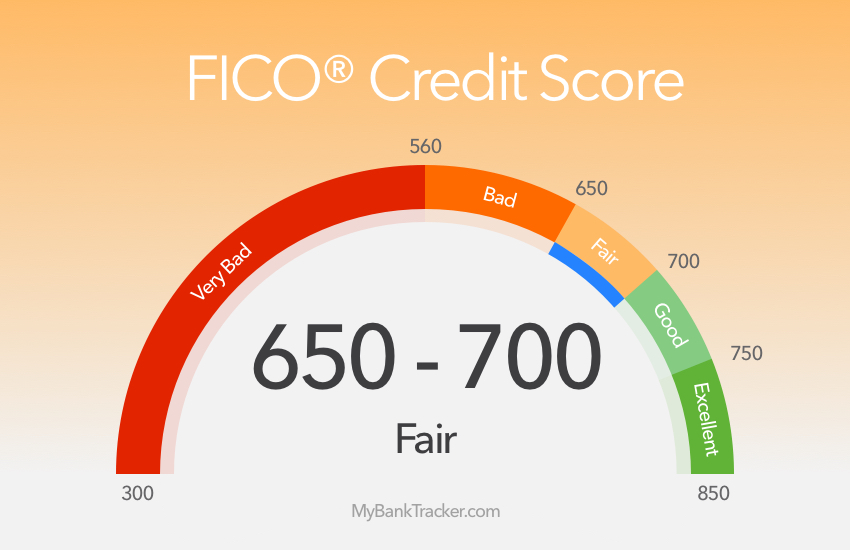

Credit score is a numerical figure consisting of three digits that symbolizes your creditworthiness. In more straightforward terms, it lets the lenders know your level of risk as a borrower and how likely you are to pay back the money you borrowed, at the designated time. Credit scores typically vary between 300 and 850, with the higher scores being less risky for the banks or lenders.

Your credit score is computed from the details in your credit report, which contains:

- Payment history

- Outstanding balances of credit cards

- Duration of the credit history

- Credit account types

- Number of recent credit inquiries

Credit scores are instrumental in evaluating financial dependability not just by the banks and lenders but also by landlords, insurers, and sometimes even by the employers.

What Is a FICO Score?

A FICO score is a very distinct credit score type that has been designed and developed by the Fair Isaac Corporation (FICO). FICO scores, which were first introduced in 1989, are the credit scores that the U.S. lending industry, in particular, uses most frequently.

Industry data states that more than 90% of leading lenders depend on FICO scores while making decisions on lending. Hence, the FICO score turns out to be the most significant version of your credit score when you are trying to avail of any major financial products.

FICO scores also have a range of 300 to 850 just like the other scores, and the same proprietary formula that uses data from your credit reports determines the score.

How to Improve Your Credit Score After Missing Student Loan Payments?

FICO vs Credit Score: Differences

1. FICO Is a Type of Credit Score

FICO was not the only, but the most important difference is that it is not separate from credit scores, it is a credit score brand. In case someone says “credit score,” the person may mean:

- A FICO score, or

- A different scoring model like VantageScore

In this way, all FICO scores belong to the credit range, but not every credit score is a FICO score.

2. Scoring Models Used

FICO holds a dominant position in the market, but it is not the only scoring model that can be used.

FICO Score: Originated by Fair Isaac Corporation, widely accepted among banks and used by mortgage lenders.

VantageScore: Created jointly by Experian, Equifax, and TransUnion, it is often the case that people rely on free credit monitoring services.

Both techniques take data into account in a similar manner, but they do so according to different priorities which can result in different scores for you depending on the platform.

3. Calculation Method and Weightage

There might be factors in both FICO scores and the other credit scores which are alike but the weightage given to each of them is different.

FICO Score factors are:

- Payment history (35%);

- Amounts owed (30%);

- Length of credit history (15%);

- Credit mix (10%);

- New credit inquiries (10%).

Other credit score models could, however, put more or less weight on certain factors.

4. Versions and Updates

FICO regularly introduces new versions of its scoring model like FICO Score 8, FICO Score 9, and FICO Score 10. Nonetheless, certain creditors continue to utilize previous versions, particularly in mortgage lending.

Correspondingly, other scoring models also have various versions. Therefore, every consumer does not possess a single credit score, rather they have a constellation of scores determined by the model and version employed.

FICO vs Credit Score: Similarities

1. Identical Score Range

FICO scores and most other credit scores share the same range of scores from 300 to 850, thus they are in fact very easy to compare at a basic level.

- 300–579: Poor

- 580–669: Fair

- 670–739: Good

- 740–799: Very Good

- 800–850: Excellent

2. Data Derived from Credit Reports

All the credit scores including FICO, derive their calculations from the information provided by the three major credit reporting agencies:

- Experian

- Equifax

- TransUnion

If there are mistakes in your credit report, these will simultaneously affect both your FICO score and the other credit scores.

3. Affecting Lending Decisions

It does not matter if it is a FICO score or another credit score model, the lenders depend on these scores to ascertain:

- Approval or denial of the loan

- Rate of interest

- Credit limit

- Loan conditions

High scores almost always open up a wider range of financial opportunities.

Why Your Credit Score and FICO Score May Be Different?

Generally, people don’t expect to see so much variance in scores between different areas. The reason is that different scoring models or systems are applied, and also scores are computed from different credit bureaus’ data sources. Moreover, not every lender simultaneously reports to all bureaus. Thus, the score differences are usual and singularly do not reflect a problem with your credit profile.

Which One Matters More: FICO or Credit Score?

Your FICO score in most instances is more relevant as it is the score that predominantly lenders count on for crucial choices like mortgages, auto loans, and personal loans.

Nevertheless, it is still beneficial to track any credit score, FICO included. The free scores provided by apps or banks can:

- Assist you in identifying trends

- Notify you of unexpected changes

- Promote the formation of credit habits.

Not the precise number, but the general state of your credit profile is the main issue.

How to Improve Both FICO and Credit Scores?

The nice thing is that the same habits raise all credit scores, regardless of the model.

1. Make sure that all bills are paid on time.

2. Keep credit card balances at a minimum.

3. Do not ask for credit unnecessarily.

4. Keep holding credit accounts that are old.

5. Using a mix of credit means doing it responsibly.

6. Every kind of credit score gets benefit from consistent financial discipline.

Being able to differentiate between a FICO score and a credit score will enable you to make more intelligent financial decisions. Though FICO is the most commonly employed scoring model, all credit scores are still serving the same purpose of indicating how well you handle credit.