How To Activate First Premier Credit Card: The credit cards provided by First Premier Bank could initially appear appealing to those trying to improve their credit scores. But when you pass the initial impression, things quickly turn bad.

First Premier cards’ main selling point is that they are “unsecured.” This indicates that they don’t demand an upfront security deposit, in contrast to secured credit cards. There are some people who cannot afford to lock up the $200 to $300 minimum deposits required for protected cards.

Even though they don’t ask for a deposit, First Premier cards nonetheless reach into your wallet quickly, heaping on fees and charging some of the highest interest rates in the business.

A great method to take charge of your financial destiny is to apply for a First Premier Credit Card. In addition to giving you access to credit, it also offers other advantages like fraud protection, price breaks on specific purchases, early access to exclusive deals, and more. You must comprehend the type of card you are obtaining and its attributes in order to make the most of it.

To avoid any unexpected fees or charges later on, make sure you thoroughly read all the fine print. Finally, if you’re prepared to activate your First Premier Credit Card, simply follow the straightforward instructions in the Workflow background material that was supplied.

Determine Your Eligibility to Activate the Card

There are a few things you need to work out before activating and using your first premium credit card. First and foremost, confirm that you satisfy all card-related eligibility conditions. These could include age restrictions and income criteria, depending on the type of card. Additionally, look over any potential card fees and decide if you can afford them. By following these steps, you can be confident that activating your new card will be simple, stress-free, and beneficial in the long run.

First Premier Credit Card Benefits

Numerous fantastic features are included with your First Premier Credit Card to help you get the most out of your credit experience. Utilising all the freebies that come with this card can be very beneficial, including free access to the credit score reporting, cash-back rewards, and more.

Additionally, you can take advantage of special advantages including a no-rewards APR on balance transfers made within the first 90 days, account savings on transfer costs, and the ability to immediately start rebuilding your credit through regular reporting to the three major credit agencies. Activating your First Premier Credit Card is the ideal way to start getting more out of your regular credit experiences because it comes with so many useful extras.

• No yearly fee

• 1% Cash Back Rewards indefinitely

• Complete anti-fraud measures

• Excellent capabilities and security

• Employee spending caps that are specific to them

How to apply for a credit card from First Premier Bank?

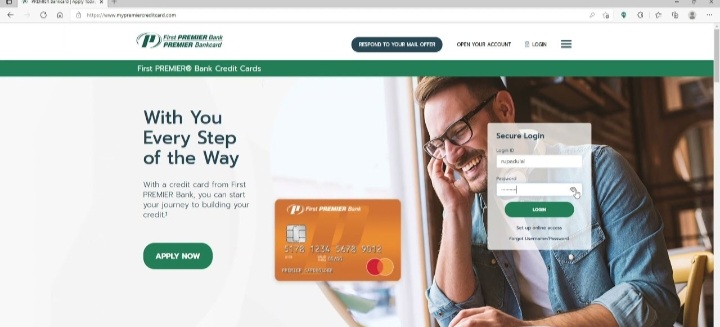

Fill out an application on the First Premier Bank website to apply for a credit card. If you get a First Premier credit card application invitation in the mail, you can input your confirmation number online under “Accept Mail Offer.” If not, select “Apply Now.” Unfortunately, phone applications are not accepted.

- Visit the website for the First Premier Bankcard.

- To submit an application if you were invited to do so, just click “Accept Mail Offer” and input your confirmation number.

- Visit the First Premier Bank’s credit card comparison webpage and click “Apply Now” next to the credit card offer you want to apply for if you want to submit an application without receiving an invitation.

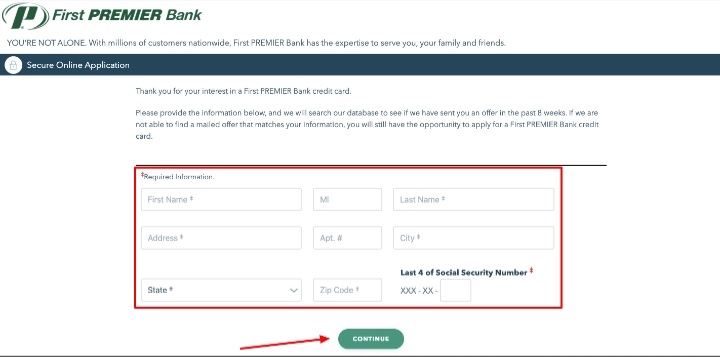

- Complete the application form with your personal data, including your complete name, address, birthdate, Social Security number (SSN), email address, information about your employer, and income.

- Look through the completed information, tick the box to agree to communication requests, and attest that you have read and comprehended all disclosures.

- At the bottom of the page, click “Submit Application” to finish.

You’ll receive a hard draw on your credit report after submitting your application. A judgement might come in as little as 60 seconds, but if your application needs more time for consideration, it might take up to 10 business days.

Credit cards from First Premier Bank are primarily intended for those with poor credit. However, that does not imply that every applicant will be accepted. Call First Premier Bank at (877) 383-4802 to inquire about the status of your First Premier credit card application if you haven’t heard anything after 48 hours.

JCPenney Credit Card Activation: Steps To Apply, Perks, Alternatives, Payments, and FAQs

How To Activate First Premier Credit Card?

You must call First Premier’s customer service line at (800) 987-5521 in order to activate your credit card. By doing it this manner and adhering to the instructions that came with your new card, you can also set up a PIN. Just be aware that there is no online activation option for the First Premier credit card.

The credit card number, the security code (CVV), or both are frequently needed for credit card activation.

It is important to keep in mind that, depending on the type of card you were authorised for, you will first need to finance the security deposit or pay the programme fee. Follow the directions on your applications page to achieve this. You will receive the card from the issuer after they have completed your payment. After that, you should receive your card in the mail within 7 to 10 business days.

Call customer support at (888) 891-2435 or the number on the back of your card to obtain a First Premier credit card PIN.

It’s crucial to remember that cash advances carry high fees and interest rates, so you should normally avoid them whenever feasible if you need a PIN for one. Additionally, although if adding a PIN would make your card slightly more practical abroad, you can still get around in the majority of tourist countries without one.

How to Monitor the Status of a First PREMIER Bank Credit Card Application?

- Call 1-800-987-5521

- Follow the on-screen instructions to verify the status of your application, or get in touch with a representative and let them know you want to do so.

- When prompted, provide your Social Security number.

- Keep an eye out for the automated voice or customer care representative to let you know if your application is granted, pending, or denied.

A decision on your First PREMIER Bank credit card application will often be made in a matter of minutes. Additionally, a lot of applications receive approval considerably sooner. You can always call customer service to find out why there was a delay if you haven’t heard anything in a fair amount of time.

When you check the progress of your application, you might not like what you find out. But individuals who are rejected can still contact First PREMIER Bank at 1-800-987-5521 to request a reconsideration.

How to Access a Credit Card Account at First PREMIER Bank?

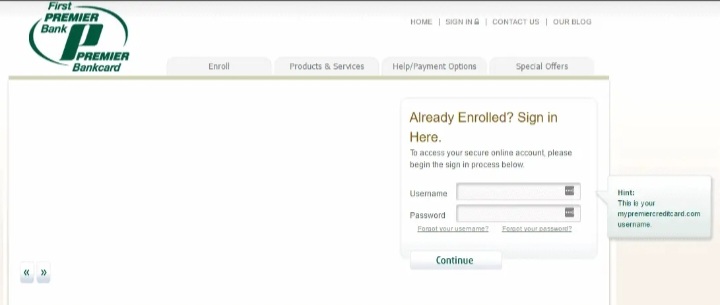

- Sign up for online account access with your First PREMIER Bank credit card.To confirm your credit card account, click “ENROL” and input your Social Security number and credit card number.

- Select a username and password for your First PREMIER Bank card.No special characters or spaces may be used in the username, which must be between 8 and 32 characters long. Upper and lower case letters, a number, or special character, as well as 8 to 64 characters, must all be present in the password.

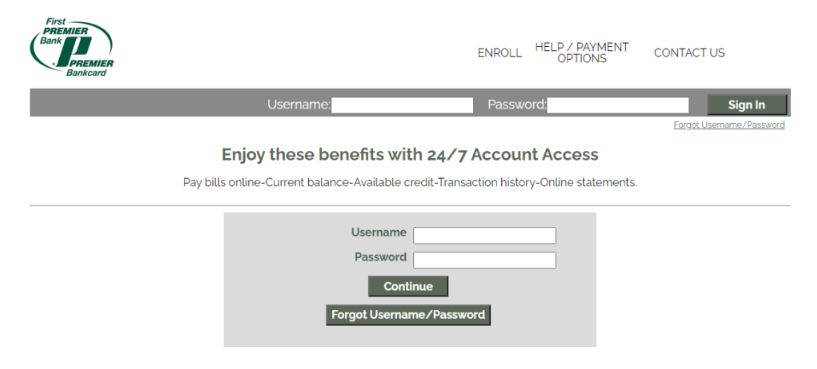

- Sign in using your new First PREMIER Bank login information. Enter your new login information in the Username and Password fields on the First PREMIER Bank website or mobile app, then click “Sign In” to access your account.

You may manage your First PREMIER Bank credit card account online after logging in and creating an account. You may manage account details, including passwords and automatic payments, as well as pay credit card bills, view credit card statements, and track account activity.

Payment Methods

The First PREMIER Bank credit card payment options include online, over the phone, via the First PREMIER Bank mobile app, by mail, and in-person at a branch. By logging into your online account and looking for the payment button, you can pay a First PREMIER Bank credit card bill online. Next, decide how much to pay, when to pay, and where to send the money. Additionally, cardholders cannot set up automated payments with First PREMIER Bank.

Selecting the First PREMIER Bank credit card payment method that best suits you is easy thanks to the variety of alternatives available.

Through ABA

MyPremierCreditCard offers a user-friendly method for managing your credit card and making payments. You can use this online tool to conduct transfers if you have the ABA and are using data from a legitimate account. The ABA ID for First PREMIER Bank is 091408598.

Online

First Premier Bank provides a very straightforward and informative overview of credit card payment options at MyPremierCreditCard, which also includes information on PREMIER Pay and cash payments via MoneyGram and Western Union. For additional assistance and information, call the number provided above.To login, register, read your statement, or manage your account online, click the “Pay Online” option below to make a payment using your First PREMIER Bank credit card

Through a Call

Call 1-800-987-5521 to make a credit card payment through First PREMIER Bank. Automated services are free, while expedited payments with help from customer support are $11.

Through Mail

For delivery, expect a week to seven days. If you choose to use an express courier instead, such UPS, delivery times of 1-3 days are available at First PREMIER Bank, 3820 N. Louise Ave, Sioux Falls, SD 57107. Please write down the account number from First PREMIER Bank on your cheque. Your statement includes your account number. It is advised that you mail your payment at least 5 working days before the deadline indicated on your monthly billing statement in order to ensure that First PREMIER Bank receives it on time.

Mailing Address

First PREMIER Bank,

PO Box 5529,

Sioux Falls, SD,

57117-5529

A few days prior to the due date, which is indicated on the monthly statement, is the ideal time to make a credit card payment. Maintaining a current account and maintaining at least the minimum payment due by the due date are essential for raising your credit score to a good or exceptional level.

If you pay with a credit card over the phone or online, it posts to your account within 1 to 3 business days. Mail-in payments will take a little longer. If both of your accounts are with the same bank and your credit card and checking account are linked, your payment may post right away. Your monthly statement contains the payment schedules for your issuer.

Customer Service Support

Call (800) 987-5521 to speak with a First Premier credit card customer service representative. Remember that representatives are accessible from 7:00 am to 9:00 pm CT on Monday through Friday and from 8:00 am to 4:30 pm CT on Saturday. Unless you want to deal with their automated system, that is.

One of First Premier’s locations is another option to get in touch with them; you can find the closest one on their website.

Access webpage

www.firstpremier.com

Send email

customercare@firstpremier.com

Mailing Address

United States, South Dakota,

Sioux Falls, 601 S. Minnesota Ave.

Frequently Asked Questions

What is the First Premier Bank credit card’s maximum credit limit?

The maximum initial credit limit set forth in its provisions is $700. You can potentially be qualified for increases in your credit limit. When your account has been open for 13 months, First Premier says you might be qualified for an increase.

What does First Premier Bank’s $95 programme fee entail?

To open the account, there is a one-time programme charge. The cost is due when your application is accepted.

Do you raise my credit limit at First Premier?

There is a 25% fee associated with requests for credit line increases, however you might be able to make one.

Where can I use my credit card from First Premier?

You can use it anyplace that Mastercard is accepted because it is a Mastercard. This comprises the majority of American and several foreign retailers.

What credit score is required for a Premier Bank credit card?

Premier Bank promotes that it welcomes customers with “poor/fair credit,” although it doesn’t specify a minimum or acceptable credit score. It simply means that if you want to learn more about your credit score or creditworthiness, you may get in touch with the business and speak to one of its bankers.

Will your credit limit will grow with a PREMIER Bankcard?

If you qualify, Premier will increase your credit limit if you apply, but there will be a fee. At 25% of the increased credit limit, the cost is somewhat high.Additionally, this charge may not be one-time only. Every time you receive approval for an increase, it will be charged.

Will a credit card from First Premier Bank improve my credit?

You are the source of your credit’s greatest support. Pay off all of your loans and credit card balances on schedule. If at all possible, refrain from charging all the way up to your credit limit so that your credit score can gradually rise. This will help because PREMIER submits credit card activity to the credit bureaus once per month and your payment history makes up 35% of your credit score.But most credit card firms act in this manner. PREMIER isn’t exceptional.

Can I use my Premier credit card to make cash withdrawals?

Cash advances are permitted by PREMIER, but they are also subject to fees. This transaction’s APR is 36%, the same as the APR that applies to purchases made with the card, but. On cash advances, there is an additional 5% cost; this is not a monthly fee. It’s paid for each transaction.