US Bank Activate Card: Getting a new U.S. Bank card is exciting but before you tap, swipe, or shop online you’ll usually need to activate it. This guide walks you through every activation path (mobile app, online banking, phone, corporate/relia cards), explains what info you’ll need, how to choose or change your PIN, what to do if activation fails, and practical security tips.

Best (fastest) method: U.S. Bank Mobile App or Online Banking (Manage Cards → Activate).

Phone activation: use the number printed on the card or the general automated lines for consumers/business.

You can usually set or change your PIN inside digital banking U.S. Bank stopped mailing PINs for new debit cards.

US Bank Activate Card

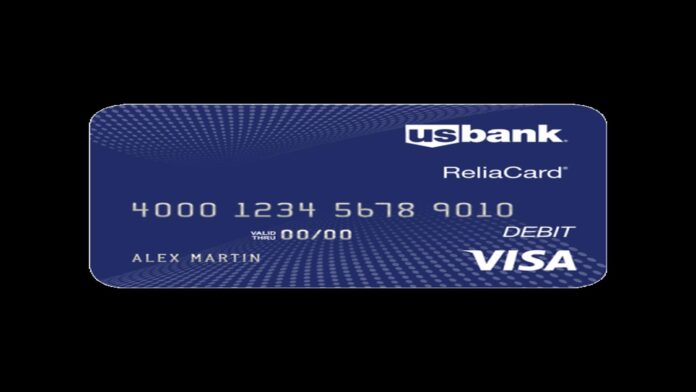

Activation tells U.S. Bank that the physical card reached the correct person and enables the network (Visa/Mastercard) to allow transactions. Activation also kicks off important fraud protections tied to your account, an unactivated card will generally decline most purchases. For corporate or special-purpose cards (ReliaCard/Focus), the activation flow can be different see the “Corporate & special cards” section.

How To Activate a U.S. Bank Debit Card?

Through App

1. Launch the U.S. Bank Mobile App (recommended) or log in to Online Banking.

2. Navigate to Manage Cards (or Accounts → Manage Cards).

3. Find your new card and click on Activate. The application will verify that you have the actual card in hand and may ask for some details (usually the last 4 digits of your SSN or card number). Confirm and complete the process, if you like, you can also set up your PIN at this time.

What you may be asked for: 16-digit card number, expiration date, CVV, last 4 of SSN, or the ZIP code on file. Keep this personal info handy but never enter it on suspicious sites.

Through Website

1. Sign into Online Banking or the Mobile App.

2. From Card controls or Manage → select Activate card.

3. Enter the card details and the requested verification (often last 4 of SSN).

If you don’t have online access, follow the activation instructions printed on the sticker that came with the card or call the phone number on the card.

By phone call

If you prefer a call (or don’t have online access), use the phone number printed on your card. Common U.S. Bank automated phone lines for card activation are available and differ by card type (consumer vs. corporate). For many corporate or program cards you might see specific activation numbers included in your card materials.

If in doubt, call the general cardmember/customer service numbers listed on the U.S. Bank site.

You may also call our automated service at to activate your card and create your PIN. They accept relay calls.

Comparison

Corporate, Focus, ReliaCard, and other special cards

Organizations that use U.S. Bank’s corporate services or payroll cards (ReliaCard, Focus) often have separate activation pages or phone lines and may request additional business identifiers (employee ID, business zip, or last four of business phone). If you were issued a corporate or ReliaCard, follow the activation instructions that came with the card or visit the program’s activation page, these differ from regular consumer flows.

Setting or changing your PIN

U.S. Bank now generally allows PIN selection in digital banking (Manage Cards → Manage PIN), they’ve moved away from printing and mailing PIN mailers for environmental reasons. If you need a PIN mailer (rare cases) or cannot set a PIN online, contact U.S. Bank customer service and they can mail a PIN mailer if the process for your card requires it.

US Bank Activate Card: What to do if activation fails?

Double-check the card number, expiration, and last-4 inputs. Typos are the most common cause.

Make sure you’re using the same name and ZIP on file with the bank. Mismatched address/ZIP can block activation.

If you don’t see Manage Cards in the app, update the app to the latest version or try logging into online banking in a browser.

For corporate or program cards, follow the program-specific activation phone number/instructions that came with the card.

If nothing works, call U.S. Bank customer service (use the number on the back of the card or the general cardmember service number). Have your card and ID ready.

Sam’s Club Credit Card: Complete 2025 Guide, Benefits, Rewards & How to Apply

What to do if your card is lost, stolen, or hasn’t arrived?

Don’t activate a card you didn’t request or that arrived unexpectedly. Contact U.S. Bank right away. Call 800-872-2657

If your mailed card never arrived, request a replacement immediately from the Mobile App, Online Banking, or by phone. U.S. Bank has options to cancel and reissue the card.

If your card was stolen after activation, report it via the app or the phone number on the back of your card so the bank can block it and issue a replacement.

Security tips

Only activate through the official U.S. Bank Mobile App, online banking at usbank.com, or the phone numbers printed on the card.

Never enter card details in links received via unsolicited email/SMS. If you get an unexpected activation link, ignore it and sign in directly at usbank.com or the app.

Create a PIN you can remember but that is not easily guessable (avoid birthdays, sequential numbers). Use the bank’s Manage PIN tool; don’t write the PIN on the card.

US Bank Activate Card: Common FAQs

Q: How soon after my activation will I be able to use my card?

A: Most of the time the card can be used right away or within a few minutes after a successful activation by app/online/phone.

Q: I have been given a temporary card. What is the method for its activation?

A: Just go through the same activation process (app/online/phone) temporary cards usually have different numbers and therefore have to be activated first if you want to use them.

Q: Is it possible for someone else to activate my card for me?

A: In general, the primary cardholder is the one who must do the activation. There may be admin workflows for business cards, so follow the instructions of your company.