Late Credit Card Payments Explained: The late payment of a credit card may seem like a very minor failure but can have a more prolonged effect on the rating than most people expect. In case you are curious about the period a delayed or missed payment remains on the credit report, its level of damage to the score, and the actions you can take to recover your score, this practical guide leads you in a very easy and understandable way through the whole process.

What Is Considered a Late Payment on a Credit Card?

A payment that the credit card issuer does, not receive on the due date is considered a late payment. However, not all late payments are reported to credit bureaus immediately.

The majority of credit card issuers adhere to this general reporting structure utilized by the major credit bureaus (Experian, Equifax, and TransUnion):

- 1–29 days late: Not reported to credit bureaus (but late fees and interest apply)

- 30 days late: Reported as a late payment.

- 60 days late: Reported again, with more severe impact

- 90+ days late: Considered seriously delinquent

Only those payments that are 30 days late or more are shown on your credit report.

If you pay off the debt later, the late payment history of the account persists anyway, unless the lender rectifies or expunges it.

How Long Does It Have an Impact on Your Credit Score?

A late payment can be included in a person’s credit report for up to seven years but its impact on the credit score is gradually lessening during this period.

The usual pattern is:

- Initial 1–2 years: The effect is the greatest and the most visible

- Subsequent 2–3 years: The reduction in the effect starts significantly

- After 4–5 years: There is a very slight effect left if no other negative reports are added

- After 7 years: The information is removed from your credit file

The credit scoring models that are used like FICO and VantageScore look more at the recent activities. Therefore, an old late payment will not affect your score as much as a new one does.

The delinquent credit card payment is recorded on your credit report for seven years from the original due date of the delinquency.

This period is determined by the Fair Credit Reporting Act (FCRA), which regulates the maximum duration of negative information on consumer credit reports.

How Much Can a Late Payment Lower Your Credit Score?

Your credit score will be lowered depending on your credit profile at the time of the late payment.

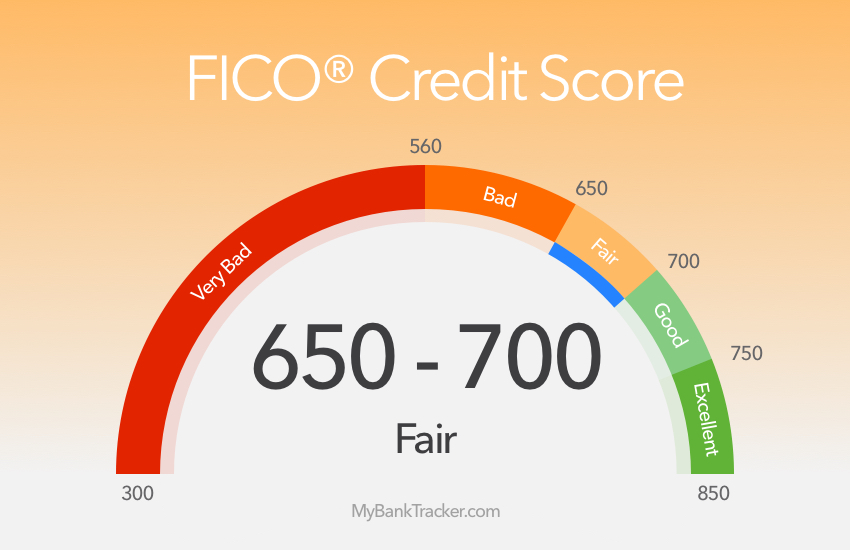

- Excellent credit (750 or more): A one-month late payment may lead to a reduction of 60 to 110 points.

- Good credit (700-749): A normal drop of 40 to 80 points.

- Fair or bad credit: The impact might be smaller, but it is still considerable.

- Heavier defaults (60 or 90 days late) will inflict more severe and longer-lasting damage to the score.

Why Payment History Is Always So Important?

It is the payment history that plays the most significant role in determining your credit score.

FICO Score: It accounts for approximately 35% of the total score

VantageScore: Also very much takes it into account

This implies that even one late payment would outweigh advantages such as a long credit history or low credit utilization.

How to Get a Cash Advance on a Capital One Credit Card: Step-by-Step Guide (2025)

Is It Possible For The Negative Mark To Be Removed Once The Late Balance Is Paid?

Settlement of the overdue amount works as a prevention mechanism against further damage, however, it won’t cancel the late payment history. Once the payment has been made, it stays on the record until it drops off naturally, unless:

- The creditor permits the removal as a goodwill adjustment.

- The late payment was filed as a dispute and was found to be misleading or untrue.

- Nevertheless, prompt payment of the full amount is still essential to avoid getting into the category of 60 or 90 days late.

Can You Remove a Late Payment Early?

In some situations, yes. The following are the legitimate alternatives:

Goodwill Adjustment: Requesting a goodwill removal from the card issuer won’t hurt your chances if you’ve got a solid payment record and the missed payment was due to a one-time issue. The approval is not guaranteed, but still many lenders are likely to take it into consideration for their loyal customers.

Disputing Errors: In case the late payment was reported wrongly, you may raise the dispute with the credit bureaus. If the lender is unable to confirm the accuracy, the payment must be taken off.

Automatic Payments Going Forward: This will not erase the previous late payments, but it does help in restoring the relationship with lenders and also acts as a safeguard against future damage.

Does a Late Payment Affect Loan and Credit Card Approvals?

Absolutely. The lenders will always scrutinize the late payments on the system very carefully before making any decision on the loan application. A recent late payment can:

- Raise loans interest rates

- Result in credit card application being declined

- Affect approved credit limit being lower than before

- Impact mortgage and auto loan getting

The more recent and the more frequent the late payments, the more lenders perceive the customer as high risk.

How to Recover From a Late Credit Card Payment?

Recovery of credit card payment defaults is certainly attainable with constant positive reinforcement. Some major steps would include:

- Payment of all future bills on time

- Keeping credit utilization at 30 percent or less

- No new delinquencies

- Old credit accounts maintained

- Credit report should be monitored regularly

- With time, good payment history would overshadow earlier mistakes.

Does a Single Late Credit Card Payment Ruin Your Credit Forever?

Definitely not. A single late payment is not a permanent mark on your credit score.

Though it might lower your score temporarily, responsible use of the credit thereafter will greatly minimize the effect. A lot of borrowers who have had late payments in the past are still able to get the best rates after waiting for the right period.

How Long a Late Credit Card Payment Really Matters?

Credit card late payment will remain on your credit report for 7 years, but its significant impact is in the first 2 years. Quick action, no more late payments, and building up with steady on-time behavior are the key things.