What is the W-4 Form: Form W-4 is a tax form that employees must complete when beginning a new employment. It instructs the employer on how much tax should be withheld from an employee’s payment.

How a W-4 form is completed can have a significant impact on whether a taxpayer receives a tax refund or owes money when they submit their tax return.

It is generally advisable to review your W-4 at least once per year. You may also wish to revisit your withholdings following events such as marriage, the delivery of a child, the receipt of a bonus, or the purchase of a home.

What is a W-4 form?

Form W-4, also known as the “Employee’s Withholding Certificate,” is an IRS form that employees fill out and submit to their employers, typically when beginning a new job. Employers use the information on a W-4 to determine the amount of tax to withhold from an employee’s paychecks throughout the year.

Am I required to revise my W-4 annually?

If your employer already has a W-4 form on file, you do not need to complete a new one. You are also not required to fill out a new W-4 every year, though it is recommended that you review your tax withholding and make any necessary adjustments to your W-4.

After submitting tax returns, the IRS advises taxpayers to use its Tax Withholding Estimator to ensure their withholdings for the current year are accurate.

The estimator, which is available in both English and Spanish, can assist you in determining if you need to complete a new W-4 form.

Events such as divorce, marriage, the addition of dependents, and secondary jobs can alter tax liability.

Exists a revised W-4 form for 2023?

Each year, the Internal Revenue Service (IRS) publishes revised versions of certain tax forms to clarify language and to update references to certain figures, such as tax credits, that may be adjusted for inflation. The W-4 form for 2023, which was released by the IRS in late 2022, can be used by employees to modify their withholding on their 2023 paychecks.

The 2023 W-4 form is virtually identical to the 2022 version. Removing a reference to the IRS withholding calculator, revising the deductions worksheet, and adding new contextual information to the Multiple Jobs section of the form are among the modifications.

. Even though the form no longer mentions the IRS’ withholding calculator, you can still use it to determine if your W-4 needs to be adjusted.

How to complete a W-4 form for 2023

Employers use the W-4 to calculate and remit certain payroll taxes on behalf of employees to the IRS and state and local authorities (if applicable). How a W-4 is completed can have a significant impact on whether taxes are owed or a refund is issued.

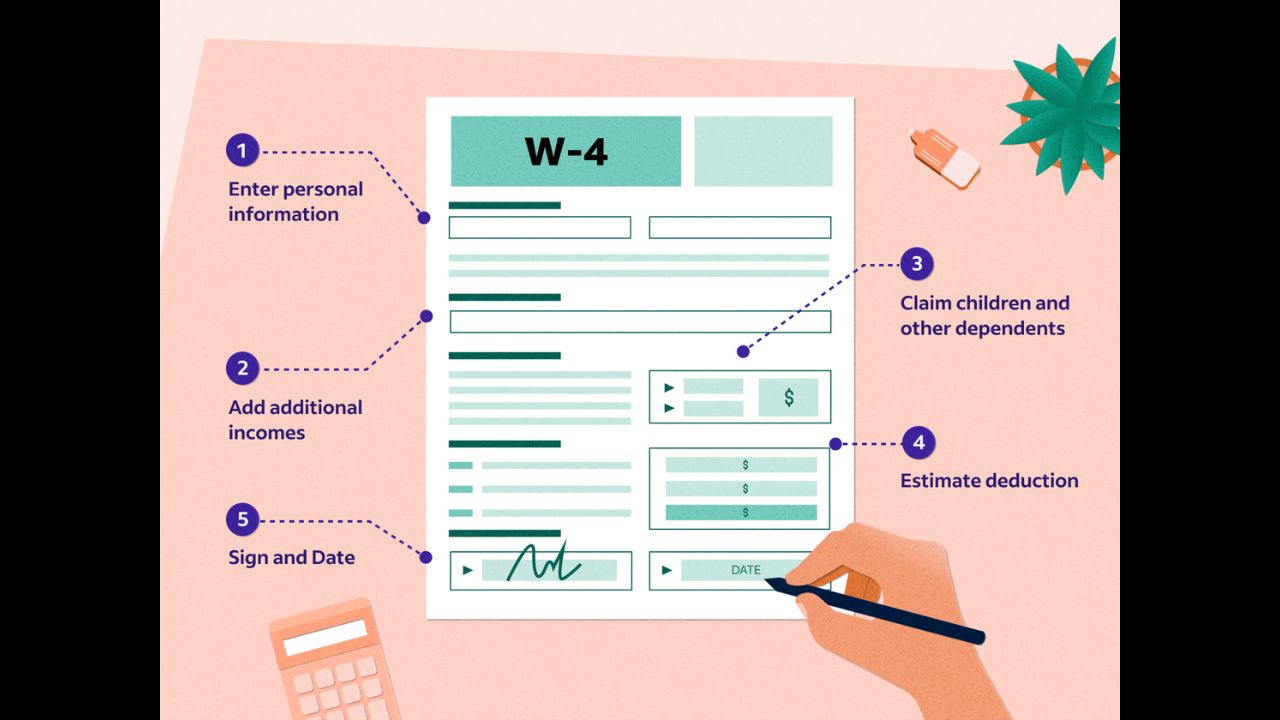

Here is an overview of how to complete a Form W-4 in 2023.

1: Fill in your personal details

Include your name, address, SSN, and tax filing status.

Importantly, based on your tax filing status, you may be eligible for certain tax credits and deductions, and there are rules governing which ones you can use.

2: Take into account multiple tasks

If you have multiple jobs or file jointly with a working spouse, follow the instructions for more accurate withholding.

Through 4(b) must be completed on the W-4 for the highest-paying job.

Leave these sections unfilled on the W-4 forms for all other employers.

If you (or both you and your spouse) have two jobs that pay essentially the same amount, tick box 2(c) instead. The caveat is that you must do this on both W-4s.

If you do not wish to disclose to your employer that you have a second job or other non-employment income sources, you have several options:

You can instruct your employer to withhold an additional quantity of tax from your paycheck at line 4(c).

Alternatively, do not include the additional income in your W-4. Instead of having taxes automatically deducted from your paycheck, you should send estimated tax payments to the IRS.

3: List your dependents, including your offspring

If your total income is less than $200,000 (or $400,000 if filing jointly), you can multiply the number of children and dependents you have by the credit amount. (See the rules regarding the child tax credit and when you can claim a dependent on your tax return.) You can also choose not to claim dependents, even if you have them, if you need a larger payroll tax deduction to reduce your tax liability.

4: Modify your withholdings

If you intend to claim deductions in addition to the standard deduction when you file your taxes, you can indicate this.

5. Sign and date the W-4 form

Sign the completed form and submit it to your employer’s human resources or payroll department. You may also be able to complete it via your employer’s online payroll system.

Download the W-4 form for 2023

Form W-4 can be downloaded from the IRS website.

The agency also distributes the W-4 form in Chinese, Korean, Russian, Spanish, and Vietnamese, among others. Here you can access forms and FAQs from prior years.

How to modify your W-4 form

If you received a large tax bill when you filed your tax return last year and wish to avoid a similar situation this year, you can use Form W-4 to increase your withholding. This will help you owe less (or nothing) on your next tax return. If you received a large tax refund last year, you are providing the government a free loan and could be living on less pay this year. Use Form W-4 to reduce your withholding.

Here are some steps you might follow to achieve a particular result:

How to have more taxes deducted from your pay

Here’s how to alter your W-4 if you want more taxes withheld from your paychecks, which may result in a lower tax bill or refund when you file your annual return.

- Reduce the dependent population.

- Add an additional withholding amount to line 4(c).

How to have less tax withheld from your pay

How to adjust your W-4 if you want less tax withheld from your paychecks, potentially resulting in a tax bill when you submit your annual tax return.

- Increase the dependent population.

- Reduce the quantity at line 4(a) or line 4(c).

- Boost the quantity in line 4(b).

How to use a W-4 to have a zero tax liability

If your goal is to structure your paycheck withholdings so that you owe no taxes when you submit your annual tax return, then the accuracy of your W-4 is essential.

Utilise the appropriate tax filing status. If you file as head of household and haven’t updated your W-4 in a few years, for instance, you may want to fill out a new W-4 if you want the amount of taxes withheld from your pay to more accurately reflect your tax liability. (Here is how to select the appropriate filing status.)

Ensure that your W-4 reflects your family’s current status. If you had a child who turned 18 or had a child born this year, your tax situation has changed and you may need to amend your W-4.

Estimate your other sources of income with precision. Line 4(a) of your W-4 should be updated if you have non-employment income from sources such as capital gains, interest on investments, rental properties, and freelancing.

Estimate your deductions accurately. The W-4 assumes that you will claim the standard deduction on your tax return. If you intend to itemise (presumably because itemising will reduce your taxes more than the standard deduction), you must estimate these additional deductions and modify line 4(b) accordingly.

Utilise the line for additional withholding. On line 4(c), you can specify the number of additional dollars to be withheld from each cheque for taxes.