How To Activate Belk Credit Card: Belk is a well-known brand among Southerners who value the department store’s great customer service, affordable prices, and broad assortment of clothing, home goods, cosmetics, and other items. Belk has hundreds of locations throughout more than 15 Southeastern states.

Depending on your annual spending, the Synchrony Bank-issued Belk credit card gives rewards at rates that are excellent, ranging from 4% to 7%.

However, if you rarely buy at Belk or if there’s a risk you’ll carry a balance from your Belk purchases, a more straightforward cash-back credit card might be a better option for you.

Belk Credit Card Features

The card comes in two different formats.

You can really be approved for two different Belk credit card options with a single application. Your financial history and credit ratings will ultimately determine which card is issued to you. The two cards you’ll be considered for are as follows:

• As a “closed-loop” credit card, the Belk Rewards+ card can only be used to make purchases at Belk salons, retail locations, and online at Belk.com.

• As a “open-loop” credit card, the Belk Rewards+ Mastercard enables you to use it anywhere that Mastercards are accepted.

The Belk Rewards+ Mastercard delivers rewards on eligible purchases made outside of Belk, but both cards offer the same in-store earnings and advantages; see below for more information.

Big spenders receive higher rates of incentives.

The Belk credit card, like the majority of store cards, is made to reward customers who stick with the brand by providing better benefits when you use the card more frequently at Belk. Regardless of the Belk card version you have, the following is the amount you will earn at each spending level:

Spending less than $299.99 on the card each year qualifies you for Belk’s “Insider” tier, which entitles you to 4 points for every $1 spent there, which is equal to 4% back in store rewards.

Spend $300 to $999 on the card in a single year at Belk to reach the “Premier” level, which entitles you to 5 points for every $1 you spend there, or 5% back in store rewards.

Spend $1,000 or more at Belk in a single calendar year to qualify for “Elite” status, which entitles you to 7 points for every $1 spent there, or 7% back in store rewards.

In addition, the open-loop Belk Rewards+ Mastercard version offers two points for every dollar spent on groceries and petrol in addition to one point for every dollar spent on any other non-Belk expenditures.

With either card, you can keep your current status until the end of the following year once you meet the spending requirement for a new status tier at Belk and begin earning rewards at that status with the start of the subsequent billing cycle. You would retain your Elite rank until December 31, 2024, for instance, if you attained it in September 2023.

But keep in mind that every January, the qualifying purchases needed to advance in status will reset. In the aforementioned example, your purchases from October to December 2023 wouldn’t count towards your Elite status in 2025, even if you would still have it through the end of 2024.

Rewards cannot be held back for a major purchase.

The Belk credit card isn’t the ideal option for sporadic shoppers in this regard either. Every time you accrue 500 points using your Belk credit card, a certificate for $5 in Belk Rewards Dollars is instantly generated. Certificates are normally valid for 90 days after issuance and are sent through email or through your physical credit card statement.

Up to $200 in Belk Rewards Dollars can be applied to a single purchase. However, because to the short expiration period, anyone but the most devoted Belk customers may find it difficult to accumulate enough rewards for a significant purchase.

You can combine Belk Rewards Dollars with the store’s frequent online, in-app, and paper discounts to help you save the most money.

There are financing options, however they have conditions.

As of this writing, a number of financing options are available through the Belk credit card to assist customers in spreading the expense of significant purchases over time:

• With a minimum initial purchase of $300, Conn’s x Belk purchases or guild products (including china, crystal, silver, and table linens) are eligible for the Table Top Special Payment Plan.

• If you make your first in-store purchase of qualified fine jewellery for $500 or more, you can sign up for the fine jewellery special payment plan. Once set up, the programme can be used for any subsequent $150 or more in-store purchases of fine jewellery.

• Premier and Elite level cardholders can request the Belk Rewards+ Flex Pay Plan. Until cardholders request to discontinue Flex Pay, this plan is automatically applied to all purchase types once it is engaged.

These choices operate similarly to some buy-now, pay-later arrangements. As long as you pay the stipulated minimum each month in accordance with the conditions of the plan, they permit you to finance a Belk purchase on your card without incurring interest. You can be charged interest or late fees if you don’t comply with these rules.

Also, keep in mind that purchases made using these financing options do not qualify for awards or affect your awards+ status for upcoming calendar years. Therefore, if you need to finance a sizable Belk purchase over time, a conventional credit card with a 0% initial APR may be a better option.

Both the Belk Rewards+ credit card and the Belk Rewards+ Mastercard will have variable APRs that are close to 30% as of September 2023. Although not unusual among retail credit cards, that number is above average.

This implies that in order to benefit from the increased rewards offered by the Belk credit card, you must pay the entire sum each month. If you don’t, there’s a good risk that any benefits you have earned will be outweighed by the interest you pay on the card.

How To Activate Mission Lane Credit Card? Steps, Features, Payments, and More

How To Activate Belk Credit Card?

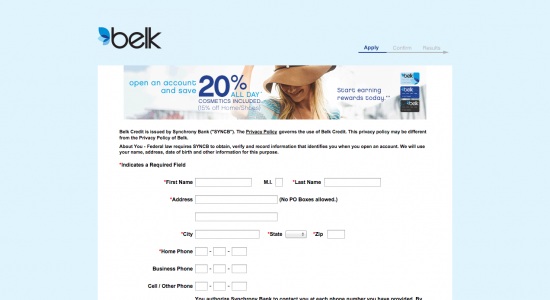

1. Go to the Belk Rewards card application page by clicking here.

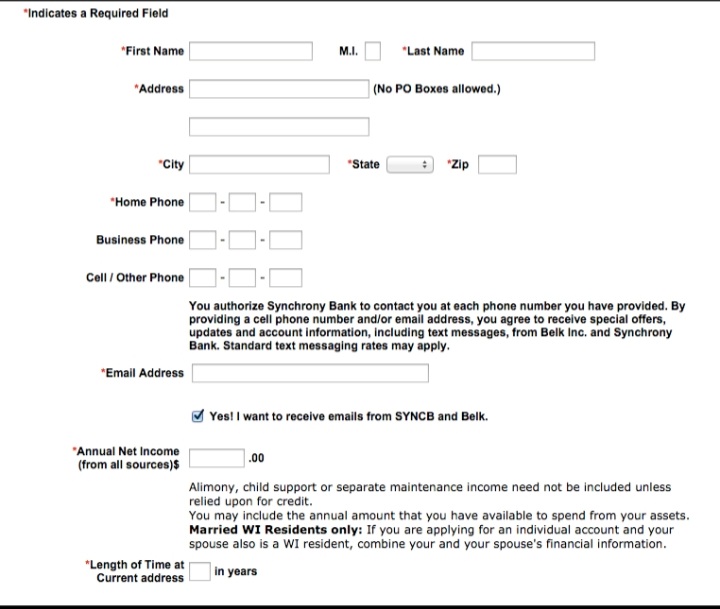

2. The following essential personal data will be requested in the application’s first section:

- First name

- Last name

- Address

- City

- State

- Zip

- Home phone number

- E-mail address

- Annual net income

- Length of time at current address

3. Fill in the following details as needed.

- Date of Birth

- Social Security number

4. The optional card security service is the application’s fourth section. If you decide to sign up for this service, your minimum payments may be dropped or your account balance of up to $10,000 may be terminated in the event of job loss, disability, hospitalisation, illness, leave from work, nursing home stay, or death. Each $100 of the monthly balance on your card will cost you $1.66 for this service.

5. Please click the grey “Yes” box to indicate that you want to join up for the optional card security service. This will act as your electronic signature. To complete the application process, click the Accept and Submit button at the bottom of the page.

How to Login Your Online Belk Credit Card Account?

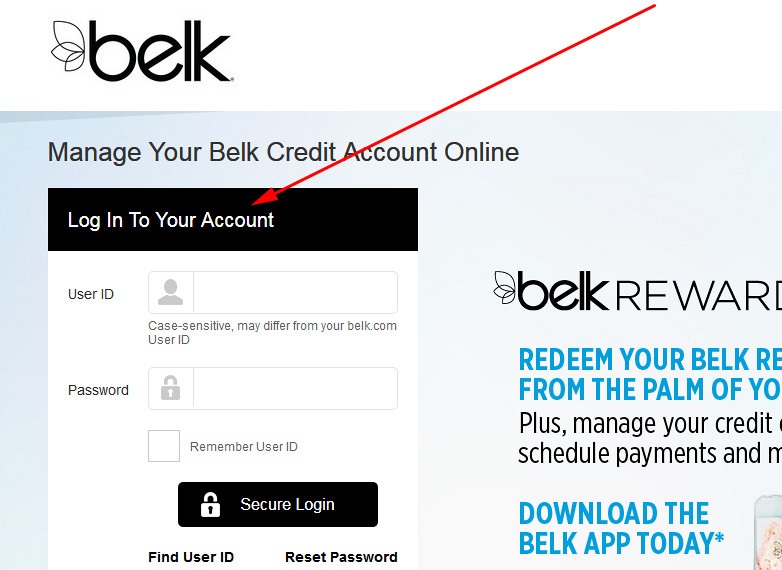

Login to Belk: You will need your user ID and password to access your Belk credit card login account online. For access to your account, follow these steps:

- Visit www.belkcredit.com/login.

- Fill out the boxes with your user name and password. Your user ID might not match the one on belk.com.

- If you wish your browser to remember your login details for subsequent visits, check the “Remember User ID” box.

- To access your account, click “Secure Belk Login”.

- If you can’t remember your user ID or password, you can reset them by clicking on the links provided in the login fields. To prove your identification, you will need to supply details such your account number, ZIP code, and social security number.

- If you just received your card and haven’t signed up for online access yet, you can do so by clicking “Register or Apply” underneath the sign-in forms. Your card number, postal code, and email address must be provided. Additionally, you’ll need to set up some security questions and answers, a user ID, and a password.

How Do I Register?

You can apply for a Belk credit card and handle your account online using the website Belkcredit.com.

The steps below must be followed in order to register on belkcredit.com:

- On the website belkcredit.com, select “Register for Online Access.”

- Type in your zip code, identification type, and credit card account number. Then select “Find My Account.”

- Enter the last four digits of your social security number or another form of identification to confirm your identity. Then select “Continue.”

- Set up your password and user ID. Select a security query and response. Accept the rules and regulations. Then select “Create Account.”

- You’ve been successful in registering with Belk Credit. You may now examine your statements, pay your bills, and more by logging into your account online.

How Do I Make an Online Payment on My Belk Credit Card?

You must first log in to your account in order to make a payment using your Belk credit card. Take the following actions to pay your bill:

- Once logged in, select “Make a Payment” from the menu on the left-hand side of the page.

- Decide on your desired payment amount. Up to your available credit limit, you may pay the minimum amount due, the statement balance, the current balance, or any other sum.

- Select the day on which you wish the payment to be handled. You can set up recurring payments or pay up to 30 days in advance.

- Decide which bank account you’ll use to make the payment. By selecting “Add a New Bank Account” and entering your routing number and account number, you can add a new bank account.

- Check your payment information, then click “Submit Payment” to finish.

- Once your money has been accepted, you will get a confirmation email. On your account dashboard, you can also see the status and history of your payments.

How Do I Pay With a Belk Credit Card Via the Mail?

You must take the following actions to pay your Belks credit card login bill via mail:

- Make a cheque or money order for at least the bare minimum indicated on your statement as being due. Payments should be made to Belk.

- Send your payment together with the payment voucher from your bill. Write your Belk credit card account number on the cheque or money order if you don’t have the coupon.

- Send your cheque, coupon or account number to the following address:

P.O. Box 669815

Texas, Dallas 75266-0765

To avoid late fines or delays, make sure to mail your money at least five days before the deadline.

How to Use a Phone to Pay with a Belk Credit Card?

Your checking account information and bank routing number must be prepared if you want to use your Belk credit card to make a phone payment. Your Belk credit card number, which can be found on your card or your billing statement, is another thing you must know. The steps are as follows:

- Dial 800-669-6550 to reach Belk’s credit card customer support. This automatic system works around-the-clock.

- When prompted by the system, speak or type in your Belk credit card number. Alternatively, you can say “representative” to speak to a live agent, albeit there may be a charge for this service.

- Comply with the directions to provide your bank routing number and checking account number. Additionally, you have a choice in the payment’s amount and due date.

- Verify your credit card information and watch for a confirmation number. Save this number in writing for your records.

You’ve successfully used your phone to make a credit card payment at Belk. In order to avoid late penalties and interest charges, make sure you pay at least the minimum amount owing by the deadline.

How to Pay in a Retail Store?

If you have a credit card from Belk, you can use cash, checks, debit cards, or money orders to make purchases at any Belk shop. The steps are as follows:

- Locate a Belk store in your area. To find the nearest one, utilise the store locator on the Belk website or app.

- Visit the store using your Belk credit card and payment method. The cashier or customer service agent must see your card.

- State that you wish to make a payment using your Belk credit card. Your card information and the amount you wish to pay will be requested.

- Complete your purchase and receive a receipt. Keep your receipt as evidence of your payment.

How to Use the Belk App to Make a Credit Card Payment?

You can use the Belk app to pay if you have a Belk credit card by following these easy steps:

- Get the Belk app from the Google Play or App Store.

- Launch the Belk app on your smartphone.

- Pick the “Me” symbol from the menu.

- Then select “Pay My Bill.”

- If you haven’t previously, sign up for online access to your Belk credit card account.

- Use the username and password you choose when registering to access your account.

- Decide on your payment method and the amount and date of your payment.

- Verify your payment information and send your payment.

Through the app, you can also set up automated payments and examine your payment history. You may conveniently and securely pay your credit card bill through the app, and you occasionally receive incentives or cashback offers.

Frequently Asked Questions

How can I apply for a credit card from Belk?

It’s simple. Enter your credit card information and select “Apply.” Alternatively, you may just click here to proceed to the application page, where you’ll need to input your cell phone number and the last four digits of your social security number.

In most circumstances, you’ll receive notification of the approval right away, however it occasionally takes up to 4 weeks.

Which Bank Issues Belk Credit Cards?

Synchrony Bank, which also issues credit cards for Toys R Us and eBay, is the company that issues the credit card for Belk.

How Can I Reach Customer Service For A Belk Credit Card?

Do you have any problems with your credit card from Belk? Well, in such scenario, calling customer support for the Belk credit card is the best course of action. Call 800-669-6550 to speak with a customer service representative about a Belk credit card.

How Do You Cancel A Credit Card?

Are there any reasons why you would like to cancel your Belk credit card? Belk credit cards cannot be cancelled online; instead, you must call 866 235 5443 to speak with a customer care representative. Once the call is connected, input your credit card information and follow the on-screen instructions to speak with a customer care representative.

Inform the customer service representative that you wish to terminate your account. To verify your identification, they could ask for other details like your date of birth and mailing address.

Which credit score is used by Synchrony Bank?

You now understand that Synchrony consults your TransUnion credit report as a result of our inquiry. It’s likely that any actions you take to raise your rating with one bureau will also raise it with the other two.