Lane Bryant Credit Card: Numerous catchphrases have been used to promote the Lane Bryant apparel line throughout the years, including “Nobody fits you like Lane Bryant.” Sadly, the Lane Bryant Credit Card falls short in many ways.

It has flaws that are all too typical of shop credit cards, like a ridiculously high APR (29.99% as of this writing), bad rewards value, and few alternatives for redemption.

Even most devoted fans of Lane Bryant would be wise to consider a general rewards credit card.

How to Use a Lane Bryant Card?

Women’s plus-size retailer Lane Bryant provides its customers with a retail reward credit card, similar to many other merchants. The company that provides credit card services to hundreds of retailers across the nation, Comenity, is the one who actually offers the card. Although the card comes with a number of alluring benefits, buyers should be aware of some limitations and drawbacks before applying.

There is no connection between the Lane Bryant credit card and any other card networks; it is exclusively valid in-store. The card can only be used at Lane Bryant-affiliated stores and websites, including Lane Bryant, Cacique, associated outlet locations, and the business’ websites.

Cardholders have the option of paying off their balance in full each month or spreading out their payments over a longer period of time. The card has a 25-day grace period, so users who settle the balance in full each month can avoid paying interest at all.

Rewards and Benefits

The Lane Bryant in-store credit card comes with a variety of benefits for devoted customers.

Points can be accumulated by cardholders and applied to upcoming transactions. When the account is connected with a Lane Rewards Membership, every dollar spent on purchases made with the card in-store or online earns one point.Cardholders can get a $10 incentive by exchanging 3,000 points.

When opening and using their account on the same day, new cardholders get a $20 discount off their first transaction.

Additionally, customers can:

- $75 or more in qualifying items to receive free standard shipping.

- Prolonged returns (as long as you belong to a rewards programme)

- Exclusive occasions

- Birthday special deal

The following table breaks down the several tiers of cardholders who participate in the rewards programme:

- Silver (up to $349): extended returns for 60 days and 15 points for every $1 spent.

- Gold (spend between $350 and $799): extended returns for 60 days and 20 points every $1 spent.

- Platinum (over $800 spent): extended returns for 60 days and 25 points for every $1 spent.

How To Apply For The Credit Card?

It’s fairly easy to apply for a Lane Bryant credit card. To apply for the Lane Bryant credit card, just follow these simple steps:

- Visit the official website to get the application for a credit card from Lane Bryant.

- The “Apply” button must only be found on the homepage after that.

- At this point, complete all the fields on the page.

- Include the following information in your introduction: first name, last name, and a government-issued identity number.

- You must also include a portable telephone system, your postal code, and your street address.

- After carefully reading the Account Terms and Conditions, you must eventually tick the box to indicate your acceptance in order to receive your Lane Bryant Credit Card.

- Continue to scroll until you see the “Submit Application” button. The only thing left to do is wait for your Lane Bryant Credit Card status. A week would be about right for the same.

How To Activate Lane Bryant Credit Card?

You must register your card if this is your first time visiting the account management centre. To access the registration form, click the grey “Sign up” icon on the home page. The last four digits of your Social Security number and your zip code are required if you know your account number. You’ll need your full Social Security number, first initial, last name, date of birth, and zip code if you don’t know your account number. After entering these information, you’ll be able to create login credentials and, if you so desire, sign up for paperless statements.

How to Open a Credit Account with Lane Bryant?

That isn’t really a huge deal. A Lane Bryant credit card will make this procedure easier. You don’t have one, do you? Visit www.c.comenity.net to learn how to apply for a credit card from Lane Bryant. You must, however, adhere to these guidelines in order to establish an account.

- Visit the official website, www.c.comenity.net. By clicking the aforementioned link, sign in to the website right immediately.

- You can get there by selecting the Register for Online Access button.

- Select the same button to proceed.

- The next phase entails moving to a whole other page and going through three distinct stages.

- Enter your card number and any other necessary information so that your credit card information can be accessed on page 1.

- Clicking should be delayed for 5 seconds.

- Please provide your name, valid Social Security number, email address, username, street address, and password.

- After confirming your account, you will receive a notification with your login information once the procedure is complete.

- Give your account a try; you’ll be happy you did.

Chase Credit Card Activation: Steps to activate, Payments Guide, Types, and FAQs

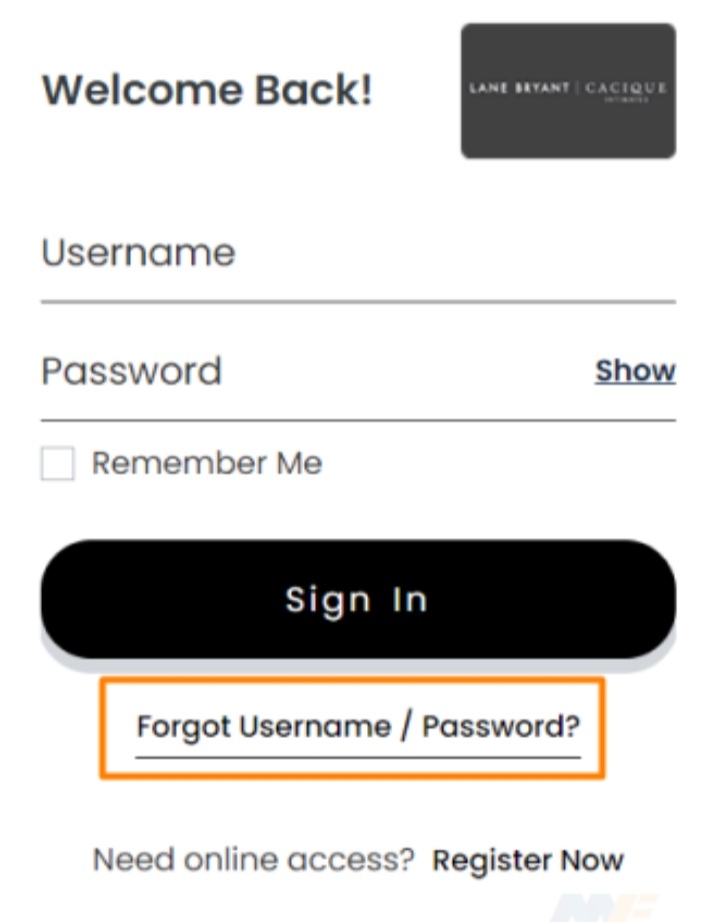

Steps to Login

The majority of credit card holders access their accounts online to pay their bills, read their statement history, check their balance, and confirm their reward points. To connect your credit cards, certain credit card providers offer apps on the Apple iPhone App Store, Google Play Store, and Android App Market. Therefore, adhere to the instructions below and do so each time you need to log into your account.

- Go to the Lane Bryant credit card login page at https://c.comenity.net/ac/lanebryant/public/home and select the login option.

- Next, fill in the sections that ask for your login and password.

- When you’re finished, simply click the last connection.

- You are finished now, and it is too.

You may access the overview of your Lane Bryant credit card account, make payments, and amend your profile information after logging in. Additionally, you can enable eStatements and set up an automated payment so that your monthly bill automatically transfers funds from a savings or checking account to savings each month.

Reset your Lane Bryant account password

- Click this link to access the Lane Bryant credit card application form: https://c.comenity.net/ac/lanebryant/public/home.

- Click Sign In if you haven’t previously done so on the Lane Bryant Credit Card homepage.

- If you don’t already have a login or password, click the Forgot username/password? link on the following screen.

- To activate your account, you must enter your username, password, and the last four digits of your social security number.

- After finishing the form’s fields, click Find My Account.

- You will be prompted to enter your information and follow the automated procedures on the Lane Bryant credit card system.

- If you take the aforementioned actions, you can quickly forget your username for your Lane Bryant credit card.

How to Make a Payment on a Lane Bryant Credit Card?

Online bill payment is becoming more and more common. Paying your bills just became simpler thanks to the power of the internet and the availability of simple-to-use apps on your phone.

Online Bryant Credit Card Payment:

To make an online payment with your Lane Bryant credit card, simply follow the steps below.

- Compile the routing, account, and credit card numbers.

- Visit the credit card account webpage.

- Log in to your account using the username and password you used when creating it.

- To make the payment, abide by the directions.

Phone Payment

Calling in your payment using a Lane Bryant credit card is an additional choice. It resembles:

- To process the payment, collect your account number, social security number, and payment details.

- Dial 800-888-4163 and follow the on-screen instructions to process the payment.

- The minimum payment amount and the deadline will be displayed by the system. Please be aware that there can be charges associated with phone requests for quick payment.

Paying through mail:

You can send a cheque, money order or pay over the phone if paying online or over the phone is not practical for you. Ensure that your payment includes the minimum payment as well as your account number. Checks or money orders made payable to Comenity-Lane Bryant may be used to make payments.

Mail your payment to:

Comity Lane Bryant

Box 659728 DUST

78265-9728 San Antonio, Texas

Customer Care Hours

On holidays, Live Customer Care hours may change. You can get automated customer support every day, all day, every day of the year.

Client Service Address

Comenity Bank Columbus,

OH 43218-2273 PO Box 182273

Frequently Asked Questions

Where can I get a Lane Bryant Card?

To get the Credit Card, you need to fill out an application. This can be done either in-person at the register of any store or online. The same criteria that govern any other line of credit, such as B. Solvency, income, and other debt, are used to assess whether a credit limit is approved.

How Much Credit Will the Bryant Card Require?

The minimal credit score needed to get approved for this credit card is not disclosed by Comenity. You must, at the very least, have a credit score that is acceptable to be eligible. Experian calculates that to be at least 580. This isn’t a strict rule, of course. Before requesting this or any other credit card, check your credit score.

Where Can I Use My Lane Bryant Card?

The Lane Bryant Card can only be used at locations that accept it by Lane Bryant Cardholders. These comprise Cacique stores, Lane Bryant stores, and any other businesses connected to Lane Bryant. As an alternative, you can make purchases on the company’s website using the card. Since this is a business credit card, you cannot use it to make regular purchases at other retail establishments.