Mortgage Rates for June 20 2023: This week’s Federal Reserve actions on inflation, or lack thereof, had little effect on mortgage rates. According to Mortgage News Daily, the average rate for a 30-year fixed-rate mortgage was 6.95 per cent on June 16, up just 0.03% from the previous week.

It was the first time in 15 months that the Fed decided against raising interest rates in its ongoing effort to reduce inflation. Since the beginning of the campaign in March 2022, the federal funds rate (the cost for banks to borrow from one another) has increased by 5 percentage points, from 5% to 5.25 per cent.

As a consequence, all types of borrowing have become more expensive over the past year, including mortgage loans. (The Fed does not set mortgage rates, but they tend to increase in tandem with the prime lending rate.) In addition, rates have recently begun to inch closer to the 20-year highs they reached last November.

Currently, the average 15-year fixed-rate mortgage rate is 6.30 percent, while the average jumbo mortgage rate is 6.69 percent. The average rate for a 5/1 ARM is 6.90%. It is not impossible to discover better mortgage rates by comparing offers from multiple lenders.

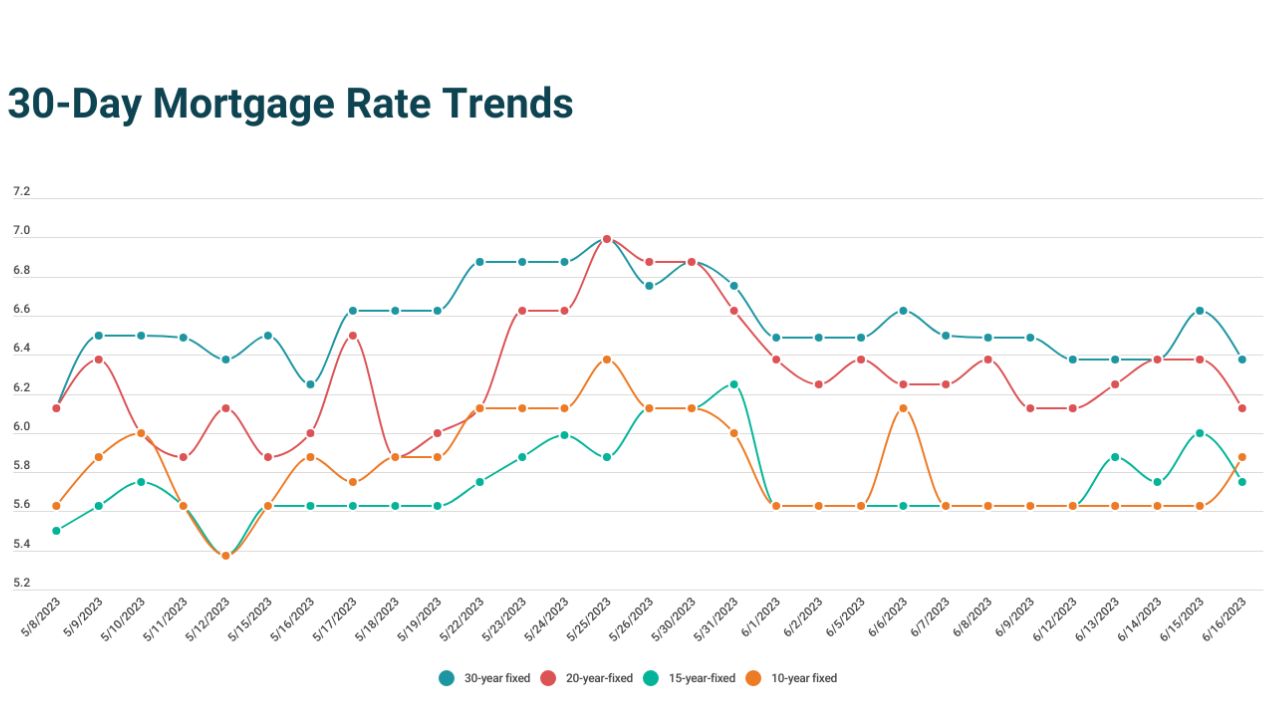

Mortgage Rates for June 20 2023: Mortgage rate patterns

The 30-year fixed mortgage rates have more than doubled since 2020 and 2021, when they dropped below 3%. However, some economists are optimistic that the Fed’s decision to maintain the federal funds rate will lead to a decline in mortgage rates, albeit a gradual one, as it takes time for policy effects to filter down to consumer products.

Mortgage rates are more closely correlated with the movement of the 10-year Treasury yield, which declined to 3.72 percent this week in response to reports that inflation is beginning to moderate. Lawrence Yun, chief economist for the National Association of Realtors, told Realtor magazine that the 30-year mortgage rate is typically between 5.5 percent and 5.7 percent. “Of course, we are aware that mortgage rates have been close to 7 percent recently, but a decline is possible as the year progresses.”

Many analysts have focused on the possibility that the Fed will implement two additional quarter-point rate hikes later this year, after assessing the complete impact of its previous actions. In the interim, there are indications that the Fed’s policy changes are bearing fruit: In May, the Consumer Price Index increased by 4% annually, the smallest increase since 2021 but still well above the target of 2%.

By increasing interest rates, the Fed hopes to decelerate the economy sufficiently to contain inflation. Economists continue to forecast a recession in 2023, and once the economy eventually cools, mortgage rates will likely decline, though it’s difficult to predict exactly when.

Housing market tendencies

Homebuyers have been sensitive to rate fluctuations this spring, entering and exiting the housing market as rates rise and decline. According to the Mortgage Bankers Association, mortgage application volume increased 7.2% from the previous week to the week ending June 9.

“Mortgage applications increased week-over-week, but remained well below year-ago levels,” said MBA vice president and deputy chief economist Joel Kan. “Rates that are still more than one percentage point higher than they were a year ago and a lack of homes for sale continue to inhibit homebuying in many markets.”

According to Redfin’s weekly housing market report, the number of new listings decreased 23% from the same period last year for the four weeks ending June 11. As a consequence, the total number of homes on the market has decreased by 6% annually, the greatest annual decline in 15 months. In the meantime, the median sale price is only decreasing by 1.1% compared to 2022, as a result of the limited inventory that has sparked bidding battles in the most competitive markets.

Potential homebuyers who are monitoring mortgage rates and waiting for the ideal time to purchase may not want to delay too long. Numerous economists foresee an impending credit crisis — when banks restrict borrowing to stabilise their finances — which would make it more difficult to obtain a mortgage in the coming months. This means that there is a window of opportunity for prospective homebuyers to secure in a favourable rate right now. Comparing rates from multiple lenders will assist you in locating the best loan for your circumstances.

30-year fixed interest rates for mortgages

The average 30-year mortgage interest rate on June 16 was 6.95 percent, up from 6.92 percent on June 9.

Fixed 15-year mortgage interest rates

The average 15-year mortgage interest rate on June 16 was the same as on June 9: 6.30 percent.

Mortgage interest rates for jumbo loans

The average interest rate for a 30-year fixed-rate jumbo mortgage was 6.69 percent on June 16, up from 6.69 percent on June 9.

5/1 adjustable-rate mortgages

The average interest rate for a 5/1 adjustable-rate mortgage on June 16 was 6.90%, a tiny decrease from 6.92% on June 9.

Mortgage Rates for June 20 2023: What factors influence mortgage rates?

There are a number of factors that influence mortgage rates, including:

- Your credit rating

- Initial payment

- Your debt-to-income ratio (DTI) is a measure of your financial health.

- The kind of loan you are receiving

- Loan term

- Type of interest rate (fixed versus variable)

- Inflation and the economy as a whole

- The Federal Reserve (which does not set mortgage rates but influences them significantly)

Mortgage Rates for June 20 2023: Should you secure your mortgage’s interest rate?

Locking in your mortgage rate establishes the interest rate for a predetermined time period, typically 30, 45, or 60 days. If the lender hasn’t processed your loan within the specified timeframe, you can either negotiate for a lock extension or accept the current mortgage rate. Once you lock in the rate, it will remain unchanged unless you make any of the following modifications to your application:

- Changing to an alternative loan type

- Modifying your down payment amount

- Changing the loan’s principal amount

- The home appraisal is drastically different from the estimate.

- Your credit score decreases

- Your earnings cannot be authenticated.

Recent mortgage rate volatility makes it difficult to determine if it makes sense to lock in your rate. If they continue to rise, locking in your interest rate will protect you. However, if they decline, you may pass out at a lower rate. Here are some instances in which it is prudent to lock in your rate:

- You believe you are currently receiving the best feasible rate from your lender.

- You’re concerned about interest rates rising again

- There is sufficient time to close before the rate hold expires.

- You desire assurance regarding your mortgage rate.

- You don’t want anything unexpected to occur at closing regarding the mortgage rate.